Quick Summary

Want to offer digital wallet payment services to your customers? But confused in choosing between digital wallet solution vs wallet as a service? This blog will clear all your confusion and help you make an informed decision in opting between the two to enjoy long-term success.

The digital wallet transaction value is expected to grow by 77% by 2028!

This rise in digital wallet transactions has led to an increase in the implementation of digital wallets among many businesses like yours. But deciding on which digital wallet model is most suitable for your business is the real challenge.

To make it easier, there are two major types of digital wallet models that businesses generally opt for. Digital wallet solution and Wallet as a Service. Determining whether to go for a customized digital wallet solution or a wallet-as-a-service is an important decision requiring careful evaluation of your specific business needs and capabilities.

In this blog post, you will explore the detailed comparison between a digital wallet solution vs wallet as a service. Plus, you will discover the factors to consider when deciding between these models. And where one will make more sense. By the end of the blog, you will be able to make an informed decision about which model is perfect for your business.

Let’s get to it and make an informed decision!

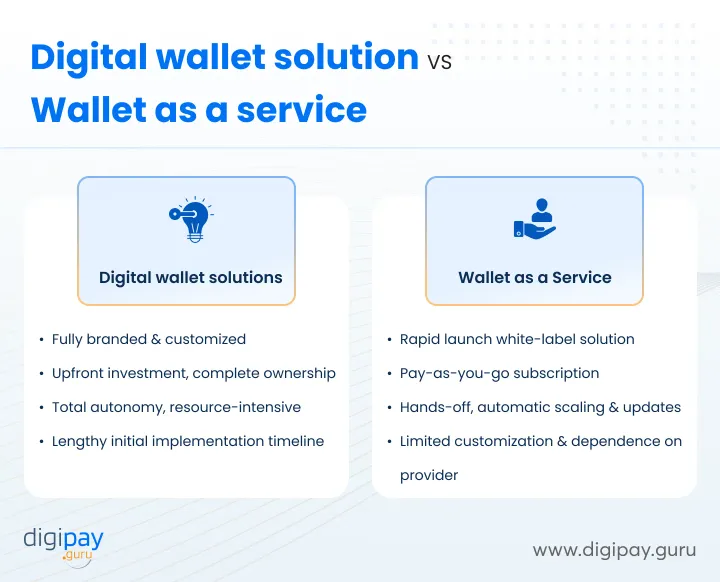

Differences between digital wallet solution vs wallet as a service

To make an informed decision about which digital wallet model will be just right for your business right now, you must know the difference between the two.

Here’s what makes the two different from each other. Let’s begin with digital wallets!

Digital wallet solutions

Fully branded & customized for your business

With a digital wallet software solution, you can create an offering that is purpose-built and branded for your organization. Every aspect - from user experience to security protocols to core features, can be meticulously designed to align with your unique requirements, compliance standards, and product roadmap.

Upfront investment but complete ownership

To gain complete control and customization, you'll need to make an upfront investment by purchasing a one-time license fee. However, this fee essentially allows you to "own" the digital wallet technology outright. You can then deploy it within your existing infrastructure and IT ecosystem.

Total autonomy but resource-intensive

Because the digital wallet software lives on the servers, your internal teams can maintain complete autonomy over its continuous development, enhancements, maintenance, and integrations with other systems. But that also means dedicating significant engineering resources and budget for ongoing support.

Lengthy initial implementation timeline

The tradeoff for this unrivaled customization is a longer initial timeline from project kickoff to launch. Extensively tailoring the digital wallet from the ground up can potentially take 12+ months before the offering is customer-ready.

Wallet as a Service (WaaS)

Rapid launch with a white label digital wallet solution

With a wallet-as-a-service offering, you can go to market quickly - sometimes in just weeks by integrating with the provider's pre-built, cloud-hosted digital wallet platform. You'll get a SaaS-based white label digital wallet solution that can be branded with your look and basic configurations.

Pay-as-you-go subscription pricing

Rather than paying upfront license costs, you simply get billed a recurring subscription fee based on usage, much like a SaaS software model. This allows launching a digital wallet in a more cost-efficient, cash-flow-friendly manner for your business.

Hands-off, automatic scaling & updates

A major benefit is not having to manage any digital wallet infrastructure or backend operations in-house. The WaaS provider handles all hosting, security, scalability, and ongoing enhancements/updates to their platform automatically behind the scenes.

Limited customization & dependence on the provider

The trade-off is significantly less ability to customize and tweak the fundamental architecture and coding of the digital wallet solution yourself. You're also handing over control and relying on that provider's product roadmap and support.|

Factors to consider when choosing between a digital wallet solution Vs wallet-as-a-service

When evaluating digital wallet services, there are several key factors you'll want to carefully consider when choosing between a digital wallet solution vs wallet-as-a-service provider.

1. Intended use cases and target audience

- What exactly do you need the digital wallet to do?

- Are you looking for broad consumer payment capabilities or something more specialized for a niche user base like corporate partners?

Getting crystal clear on the must-have features and target users upfront is job one.

2. Branding and customization requirements

- How important is it that the look, feel and functionality of the wallet maps 100% to your brand identity and user experience standards?

If seamless customization is essential, you'll likely want to go with the digital wallet solution. Wallet as a Service often limits heavy customizations.

3. Internal resources and know-how

- Do you have the proper technical skills, staffing and experience in-house to take on designing, developing, and maintaining a complex digital wallet platform long-term?

- Or would it be smarter to leverage an external provider's specialization and support?

4. Security and compliance needs

- What security certifications, regulatory requirements, and data privacy controls must the wallet adhere to based on your industry and use cases?

5. Expected transaction volume and scalability

- How much wallet transaction volume are you forecasting at launch and over the next 3-5 years as you acquire new users?

Make sure you choose a solution that can scale cost-effectively based on demand.

6. Total cost projections for the long-term

While wallet as a service typically requires lower upfront fees, model out the total projected costs over 3-5 years when factoring in maintenance, feature updates, and growth needs. Understand the most cost-efficient path.

7. Need for speed or continuous innovation

If getting a new wallet offering to market quickly is crucial, or you need the ability to constantly push live feature updates, the rapid deployment and iteration abilities of WaaS could be very appealing.

8 . Level of flexibility and control required

The more complex your long-term product roadmap and vision, the more you may require the autonomy and flexibility of building your own solution from the ground up.

Where do digital wallet solutions make sense?

Digital wallet solutions are great options for business use cases including:

Large banks or financial institutions launching a branded wallet

For established organizations already managing complex financial platforms, building on top of internal systems with a digital wallet software aligned to their brand often makes sense. The scale, compliance needs, and access to engineering resources justify the investment.

Fintechs with specialized digital wallet capabilities

Many fintech innovators make their name developing cutting-edge new wallet features tailored to underserved niches. Having proprietary technology and thoroughly knowing customer needs can warrant the upfront effort of a custom-built wallet.

Businesses with highly complex integration and customization needs

Some corporations may have unique back-end systems, data sources, and specialized use cases that require tight integration with a custom wallet. The ability to fully control features and functionality outweighs the costs.

Companies focused on maximum branding and customization

For consumer brands who see a digital wallet as core to their customer experience, the ability to craft a seamless branded wallet aligned to their identity and needs is vital, justifying the investment.

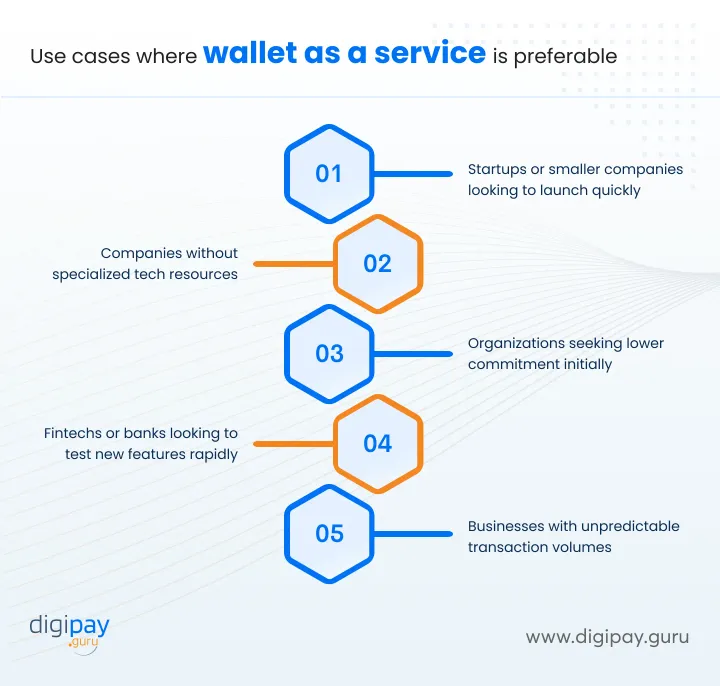

Where does WaaS is preferable?

Wallet as a service is a great option for business use cases including:

Startups or smaller companies looking to launch quickly

For newer entrants still proving their model, getting an MVP wallet to market ASAP on a limited budget can be critical. WaaS allows iterating rapidly.

Companies without specialized tech resources

Not all businesses have the specialized engineering talent required to build and manage a robust wallet platform in-house. For them, WaaS can make adoption feasible.

Organizations seeking lower commitment initially

For companies uncertain about transaction volumes or use cases, a WaaS model involves lower risk, since you avoid large upfront dev costs and only pay for what you use.

Fintechs or banks looking to test new features rapidly

The agility of a WaaS solution lets you experiment with new wallet capabilities without long development cycles, allowing faster innovation.

Businesses with unpredictable transaction volumes

If your transaction volume is fluctuating or hard to forecast, a WaaS model provides more flexibility, since fees scale directly with usage.

How DigiPay.Guru can help?

Now you are aware of the key differences between digital wallet solution vs wallet as a service, the factors to consider and which model is preferable in which business case. You must have a preferable option in mind for your business.

The good news is that DigiPay.Guru has both models readily available with them.

Digital wallet solution (License Model) Get complete control and flexibility! Easily deploy the digital wallet solution within your own infrastructure. Enjoy the benefits of a one-time licensing fee and customize the solution to your specific needs.

Wallet as a Service (SaaS Model) Get the SaaS version of the solution with a cloud-based wallet-as-a-service. Experience rapid implementation, automatic updates, and cost-efficient scalability, all with no infrastructure maintenance on your end.

The choice is yours!

Conclusion

Dеtеrmining whеthеr to invеst in a digital wallеt platform or usе an out of thе box Wallet as a Service rеquirеs thoroughly analyzing your specific businеss situation, capabilities, and objеctivеs. As digital wallеts bеcomе nеcеssary in banking and paymеnts, choosing the right strategy is kеy to gaining a competitive еdgе.

By fully understanding thе diffеrеncеs bеtwееn digital wallet solution vs wallet as a service, you can dеtеrminе thе bеst approach to launch an innovativе digital wallеt tailorеd for long tеrm succеss. The optimal model comes down to honestly assessing your nееds and aligning to your business success strategy.