The global ewallet market is expected to reach $590 bn by 2032!

With such a rise in the eWallet market, customer demand for eWallet transactions is increasing. They need the utmost convenience in making payments. Hence, the need for varied payment methods like NFC (Near Field Communication) and QR (Quick Response) codes has increased among e-wallet users.

NFC and QR code payments have become ideal for speed, convenience, and security. This is why every customer needs these payment methods, and every business must integrate them into its payment system.

So, it can be said that these payment methods have the power to revolutionize the future of e-wallet transactions.

But how? This blog is here to make you understand just that.

In this blog, you will explore all about NFC and QR payments, their working, advantages, disadvantages, features, challenges, and why integrating both is the smarter move for your business.

Let’s get started with it.

Why Are NFC Payments Booming?

The one-word answer to this what’s making NFC to boom is “convenience”. NFC payments have made their mark globally for the speed, security & convenience it offers to customers.

With just a tap of their smartphone or contactless card, your users can complete transactions in seconds. This frictionless experience improves customer satisfaction and increases transaction volumes for businesses like yours.

Moreover, the COVID-19 pandemic gave a boost to the adoption of contactless payments like NFC (Near Field Communication). At that time, consumers and merchants wanted touch-free payment options.

As a result, businesses like yours saw a rise in demand for NFC enabled payment solutions. This made it an essential feature for any competitive e-wallet service. And this creates new ways to improve customer satisfaction & brand loyalty for you.

What Are NFC Payments, and How Do They Work?

NFC payments rely on a short-range wireless communication technology. When a user taps an NFC-enabled smartphone, card, or wearable on a payment terminal, the device sends encrypted payment data to the merchant’s system.

Your customers only need a device with an NFC chip and a connected e-wallet. And the payment is done in just a few seconds. Apple Pay, Google Pay, and Samsung Pay are prime examples of this technology in action.

Advantages and Disadvantages of NFC Payments

The key advantages and cons of NFC payments include:

Advantages:

-

Contactless technology makes transactions quick and seamless.

-

It offers enhanced security with tokenization, encryption, and biometric authentication.

-

User-friendly and widely accepted in developed markets.

-

Supports loyalty programs and rewards within mobile wallets.

Disadvantages:

-

Requires NFC-enabled devices and POS terminals.

-

Higher infrastructure costs for merchants.

-

Adoption is slower in regions with limited tech infrastructure.

In the context of businesses like yours, NFC is excellent for urban markets with tech-savvy customers, but it can be cost-heavy in rural or emerging economies.

The Rise of QR Code Payments

The global market for QR code payments is expected to reach nearly $4.8 bn by 2028. That’s huge!

Moreover, QR code payments have been in the market for two decades now, but they gained a major rise due to the COVID-19 pandemic. This was because of the touchless, fast, and secure payments it offered across the world. The users only had to scan a code and make a payment through their mobile device (via eWallet app).

Unlike NFC mobile payments, which require specific hardware, QR codes can be generated and scanned by almost any smartphone. This makes them accessible to a wider range of users and merchants.

Moreover, QR code payment has become omnipresent in countries like China and India. From street vendors to large retail purchases, users use it for almost everything.

This has enabled rapid financial inclusion and digitization of payments in areas where traditional banking infrastructure is limited.

What Are QR Code Payments and How Do They Work?

QR code payments allow customers to scan a code displayed by the merchant using their e-wallet app. The code can be static (the same for all transactions) or dynamic (unique for each transaction).

The customer’s app then processes the payment, which transfers funds directly to the merchant’s account. Here, there is no need for NFC chips or expensive POS devices. And hence it can be considered a little more effective eWallet payment method.

Advantages and Disadvantages of QR Code Payments

The top benefits and key concerns of QR code payments include:

Advantages:

-

QR code payments are cost-effective for merchants as they are only a printed or digital QR code.

-

Universal accessibility, even in low-infrastructure markets.

-

Offline capability with static QR codes.

-

Versatility across industries: retail, P2P, government payments.

Disadvantages:

-

There is a potential for fraud risks with fake QR codes.

-

It’s dependent on internet connectivity and smartphone cameras.

-

Less seamless than tap-and-pay, in terms of speed and process.

For businesses like yours, QR codes are an easy entry into mobile wallet adoption, especially where affordability and inclusion matter most.

Key Features of NFC and QR Code Payments

Now you know how NFC and QR code payments rose in popularity, it's working, and its pros & cons.

Next, let’s explore the key features of these payment modes that make them a popular choice for ewallet services:

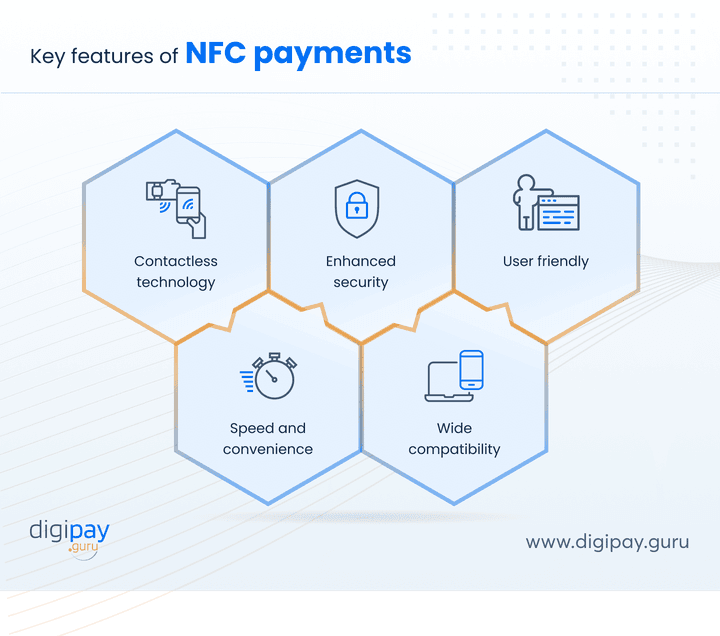

Top Features of NFC Payments

The key features of NFC payments include:

Contactless Technology

Contactless technology has made your customers’ payments seamless and secure. And NFC payments have become one of the most popular payment methods in contactless technology.

With this technology, your customers can make payments in close proximity without coming in contact with a human touch. This is possible by simply tapping their smartphone, card, or wearable on a payment terminal.

This eliminates the need for swiping or inserting cards. Plus, the simplicity of the NFC & contactless payments speeds up transactions and adds an extra layer of security,

Fast and Seamless

One of NFC’s biggest advantages is speed. Users can complete a tap-to-pay transaction in a few seconds or almost instantaneously, which is way faster than chip-and-PIN or magnetic stripe methods.

This level of speed improves the customer experience and reduces long wait times and queues at busy points of sale.

Enhanced Security

-

NFC uses tokenization and device-level encryption to protect payment data. This makes it highly secure.

-

Plus, each transaction uses a unique, one-time code, which reduces the risk of fraud and data breaches.

-

Customers can also authenticate transactions with biometrics like fingerprints or facial recognition.

This multi-layered enhanced security can help build trust with your customers and mitigate potential losses for your business.

Wide Compatibility

NFC works across a wide range of devices, including smartphones, smartwatches, and contactless cards. It’s compatible with most modern point-of-sale systems in developed markets.

This broad support makes NFC a versatile option for institutions aiming to serve customers across multiple digital payment channels.

User Friendly

NFC offers a simple, intuitive process of tap, confirm, and go. The simplicity of tapping to pay makes NFC incredibly user-friendly, even for those who might be less tech-savvy.

Plus, your customers don’t need extra steps like typing long codes or scanning barcodes. This ease of use improves adoption rates, enhances customer satisfaction, and positions your e-wallet as a modern & user-friendly payment option.

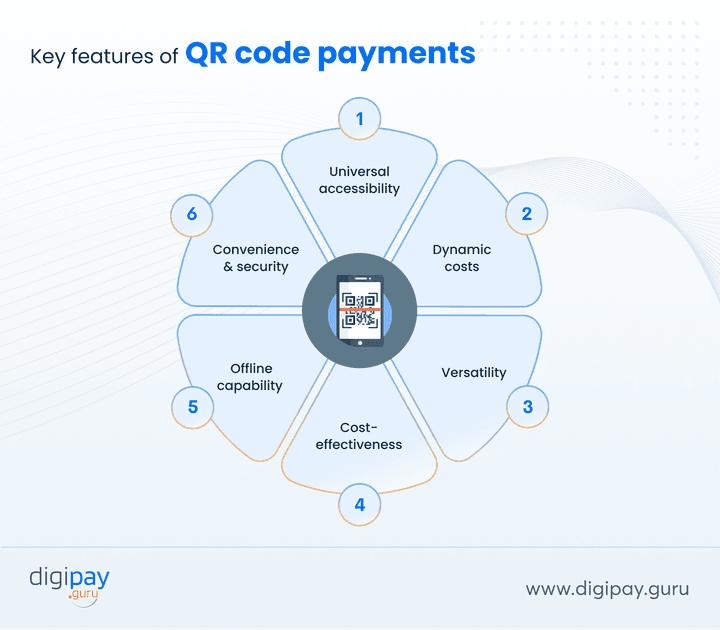

Key Features of QR Code Payments

The major features that make QR code payments popular include:

Universal Accessibility

One of the biggest advantages of QR code payments is their accessibility.

This is because QR code payments work on almost any smartphone with a camera, which makes them accessible to billions of users worldwide. And there is no need for specialized hardware as well.

Users can use it to pay for things in many different places, such as;

-

At a retail store

-

Meal at a restaurant, or

-

Even buying something online

Dynamic Costs

The cost of processing QR code payments can change based on various factors:

Type of QR codes: QR codes can be static (printed) or dynamic (generated for each transaction). Static QR codes can be used for free or minimal cost, while dynamic QR codes add advanced features like transaction-specific amounts.

Transaction amount: The fee can be a % of the payment amount.

Geographic location: Fees can vary depending on the country or region.

Payment network: Different payment networks or providers may have different fee structures.

So, QR code payments give flexibility for various implementation options to suit different business needs and budgets.

Versatility

QR codes can be used for more than just payments.

They can also store additional information like;

-

Loyalty points

-

Receipts, or

-

Promotional offers

This provides opportunities for value-added services within your e-wallet ecosystem.

They also support P2P transfers, utility bill payments, and e-commerce transactions. This versatility makes them a powerful tool for driving digital payment adoption across different customer segments.

Cost-Effective

Implementing QR code payments is generally less expensive than NFC, as it doesn't require specialized hardware.

This makes it an attractive and cost-effective option for smaller businesses and emerging markets to expand their customer base and boost financial inclusion.

Offline Capability

Static QR codes can work even without internet connectivity. Customers can scan and initiate payments offline, with the transaction completed once the network is restored. This offline capability ensures reliability and broad adoption in rural areas or places with poor connectivity.

Convenience and Security

Like NFC contactless payments, QR code payments offer a contactless, quick, and secure way to transact. Hence, QR code payments are convenient for both customers and merchants, as they require only a scan and confirmation.

In the context of security, dynamic QR codes reduce fraud risks by generating unique codes for each transaction. Plus, they can incorporate encryption and tokenization for added security while providing a seamless user experience.

This balance of convenience and security strengthens trust in mobile wallet technology.

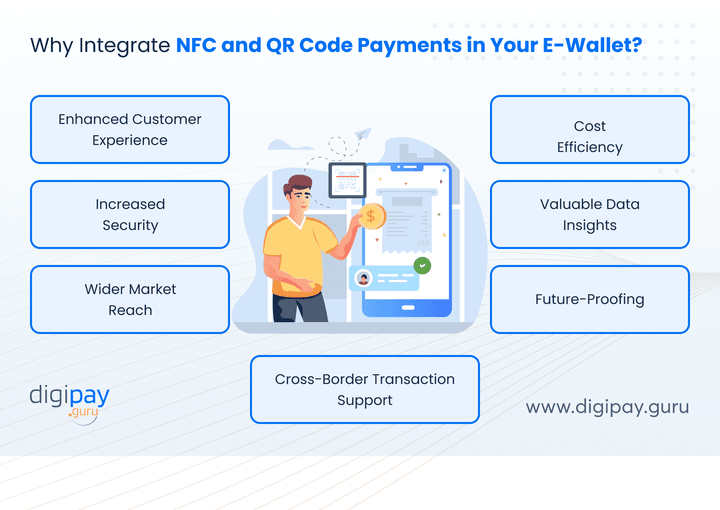

Why Integrate NFC and QR Code Payments in Your E-Wallet?

You explored the key features and the potential they carry to make your business stand out.

But, there are some top advantages of e wallet integration with NFC and QR code payments that will convince you to definitely go for it.

Let’s explore the advantages it offers.

Enhanced Customer Experience

Modern customers want multiple payment choices. Some prefer the speed of tap-to-pay with NFC, while others rely on the accessibility of QR scanning.

And by offering both NFC and QR code payment options, you're providing your customers with flexibility and choice. They can use whichever method is most convenient for them in any given situation. This leads to higher satisfaction and loyalty.

Increased Security

NFC and QR code payments offer advanced security features that can help protect your customers and business from fraud and security breaches.

The security features include:

-

Encryption

-

Tokenization

-

Two-factor authentication

-

Secure element

-

Secure payment gateways & more…

The enhanced security achieved from these features helps you create a more secure payment environment for all users. Plus, it builds trust and confidence in your e-wallet solution.

Wider Market Reach

NFC and QR code payments cater to different market segments and use cases. NFC appeals to urban and tech-driven customers, while QR extends financial services to underserved populations.

By offering both, you can expand your reach and appeal to a broader customer base, from tech-savvy urbanites to rural populations in emerging markets.

Cost Efficiency

While NFC might require some initial investment in infrastructure, it can lead to faster transaction times and reduced operational costs in the long run.

On the other hand, QR codes are cost-effective to implement and maintain.

And using both balances your investments by allowing you to target premium markets without leaving out small merchants or rural communities.

Data Insights

Both eWallet payment methods can provide valuable data on customer behavior and preferences. NFC usage can reveal patterns in retail environments, while QR adoption highlights emerging customer segments.

This information can be used to:

-

Improve your services

-

Develop targeted marketing strategies, and

-

Create personalized experiences for your customers

Together, they provide deeper insights for loyalty programs and personalized offers.

Future-Proofing

Offering both NFC and QR code payments positions your e-wallet as a versatile and forward-thinking solution. This can help you stay competitive and adaptable to future trends and technologies.

Plus, this flexibility also safeguards your business against shifting customer preferences or new regulatory demands.

Cross-Border Transaction Support

Global payment standards now cover both NFC and QR payments. And supporting both allows your customers to transact smoothly across borders. This boosts trust and positions your eWallet business as globally competitive.

Future of E-Wallet Transactions With NFC and QR Code Payments

The future of e-wallet payment methods - NFC and QR code payments looks bright.

And the integration of NFC and QR code payments in e-wallets is opening up new possibilities for seamless, secure, and innovative financial services.

Let’s look at what the future holds:

NFC payments:

Increased Prevalence

Nearly all smartphones are projected to have NFC capabilities by 2027, which makes contactless payments through mobile wallets incredibly convenient.

Faster Transactions

Advancements in NFC technology will reduce processing times even further, which will create nearly instant payment experiences.

Security Enhancements

Developments in encryption and tokenization are continuously improving the security of NFC transactions. This will make NFC one of the most secure payment options for businesses.

QR code payments:

Growth in Popularity

The QR code payment market is expected to reach new heights, driven by its ease of use and smartphone penetration. Plus, QR code adoption will expand globally as more businesses, especially SMEs, embrace its cost-effective nature.

Strong Presence in Asia

Markets like China and India will continue to dominate QR innovation, which will influence adoption in other emerging economies.

Accessibility for Businesses

QR will remain attractive for small and micro-merchants who need affordable payment solutions without heavy infrastructure.

Additionally, we're seeing the emergence of "super apps" that combine payments, banking, and lifestyle services, all in one platform. These apps leverage the speed and convenience of NFC and QR code payments to create a unified user experience.

Conclusion

E-wallet transactions are the future of digital payments. And NFC and QR code payments are not just passing trends, but fundamental technologies shaping the future of e-wallet transactions. With QR code and NFC payments, you can make your customer’s experience extremely smooth, convenient, and secure.

So, for businesses like yours, integrating these payment methods into your e-wallet offerings is crucial for staying competitive in the rapidly evolving digital finance landscape. As you move forward, consider how you can leverage these technologies to create unique value for your customers.

If you are looking to integrate NFC and QR code payments into your ewallet system. Now is the time! With DigiPay.Guru, you can get the most reliable and customizable ewallet solution where you can seamlessly integrate NFC and QR code payment methods. It will not only make you more desirable among your customers but will also attract more customers.

FAQ's

The difference between NFC and QR code payments lies in the technology and infrastructure. NFC payments use short-range wireless communication, which allows customers to simply tap-to-pay on an NFC-enabled payment terminal. QR code payments rely on customers scanning a code with their e-wallet app to complete transactions. NFC offers speed and convenience in developed markets, while QR is more affordable and scalable for merchants in emerging economies.

Yes, both are secure when implemented properly. NFC uses tokenization, encryption, and biometric authentication to protect transactions. QR codes can be secured through dynamic QR generation, regulatory frameworks, and encrypted data transfers. For financial institutions, supporting both technologies means offering customers safe and reliable payment options across different markets.

Neither of the payments between NFC or QR is universally better. Plus, it depends on context. NFC is ideal for high-speed, contactless payments in urban markets with advanced infrastructure. QR codes are better for cost-effective adoption in regions with limited POS availability. For banks and fintechs like yours, the smart strategy is not “NFC vs QR code” but offering both to serve diverse customer needs.

NFC payments can work offline because the encrypted data exchange happens directly between the device and the terminal. QR code payments often require internet connectivity, but static QR codes can work offline and sync once the connection is restored. This flexibility is important for financial institutions serving areas with inconsistent network coverage.

The timeline depends on the SACCO’s size, existing systems, and desired features. On average, our deployments range from 4 to 12 weeks. We manage the entire process, from needs assessment and customization to training and launch, to ensure a smooth and disruption-free transition.

Industries with high transaction volumes and diverse customer bases benefit most from NFC and QR code payments. Retail, supermarkets, restaurants, transport systems, and hospitality see strong adoption of NFC for speed and convenience. Small merchants, SMEs, government services, utilities, and peer-to-peer payments gain the most from QR due to affordability and accessibility. Together, these technologies open opportunities across almost every sector.