In the digital payments world, where so many crucial innovations keep coming out every now and then, contactless payments have become very significant. And NFC-enabled cards happen to be one such innovation in contactless payments.

The roots of this groundbreaking innovation can be traced back to the early 2000s when Near Field Communication (NFC) emerged as a wireless communication technology. Since then, NFC has evolved from its initial applications in sharing files and contact information to become the backbone of contactless payments.

The growth of NFC-enabled card issuance has revolutionized the way we pay, offering a seamless and secure payment experience that's transforming the world of transactions.

According to a study by Markets and Markets, contactless payments are projected to reach a staggering $17.9 billion by 2025. Additionally, a 2022 study by Business Wire says that there has been an 85% adoption of NFC contactless cards and overall contactless payment card usage has surged by over 30% in the last two years.

In this blog post, we will delve into what NFC-enabled card issuance is, the myriad benefits of NFC-enabled card issuance, explore its impact on contactless payments, and uncover how this technology is reshaping the way we transact in our increasingly interconnected world of ever-evolving trends in digital payments.

What is NFC-enabled Card Issuance?

In today's fast-paced world, where convenience is key, NFC-enabled card issuance has emerged as a game-changer in the realm of digital payments solution. But what exactly is NFC and how does it work?

Let's embark on a journey to demystify this technology and explore the intricacies of NFC-enabled card issuance, step by step.

What is NFC?

Near Field Communication (NFC) is a wireless communication technology that enables the exchange of data between two devices nearby. It operates on radio frequency identification (RFID) principles, allowing devices, such as smartphones and contactless cards, to establish a connection simply by being near each other.

The Role of NFC-Enabled Cards

NFC-enabled cards are equipped with a tiny chip and antenna that communicate with NFC-enabled devices, such as digital payment terminals or smartphones. These cards have revolutionized the way we make payments, as they allow for seamless, contactless transactions.

How Does NFC-Enabled Card Issuance Work?

-

Chip Embedding: During the card manufacturing process, a small NFC chip is securely embedded within the card. This chip contains the necessary information for communication and transaction processing.

-

Card Activation: Once the card is issued by a financial institution, it is activated for contactless payments. This typically involves linking the card to the user's account and enabling the NFC functionality.

-

Transaction Process: To make a payment, the user simply taps or holds the NFC-enabled card near a payment terminal. The terminal reads the card's information, verifies the transaction, and completes the payment process, all in a matter of seconds.

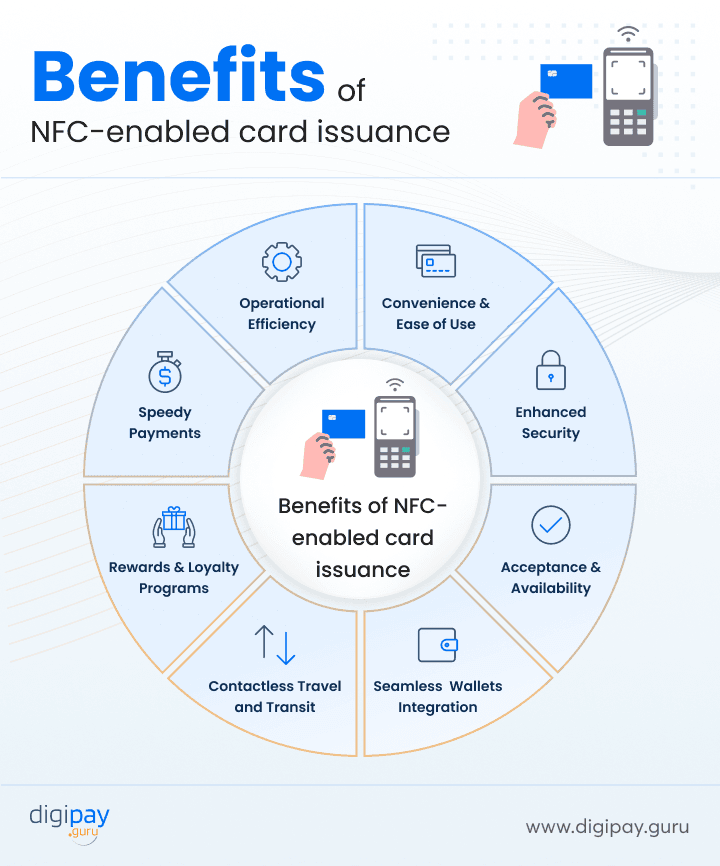

Benefits of NFC-enabled card issuance

With a seamless tap-and-go experience, these cards offer a multitude of benefits that enhance convenience, security, and efficiency. Let's explore the remarkable advantages of NFC-enabled card issuance, illustrating how they revolutionize contactless payment technology in our daily lives.

Increased Convenience & Ease of Use

NFC-enabled cards make transactions faster and more convenient. Imagine effortlessly tapping your card on a payment terminal, avoiding the hassle of swiping, inserting, or counting cash.

Whether it's buying groceries, grabbing a coffee, or commuting on public transportation, NFC mobile payments through cards simplify your payment experience, saving precious time in your busy schedule.

Enhanced Security

NFC-enabled cards provide enhanced security measures that protect your financial information. Through encryption and tokenization, these cards ensure that sensitive data transmitted during transactions remain secure.

With built-in protection against fraud and identity theft, NFC-enabled cards offer peace of mind to customers while making purchases.

Increased Acceptance & Availability

With so many contactless payment trends, its adoption has soared, with an increasing number of merchants accepting NFC-enabled cards. From local businesses to global retailers, you can confidently tap your card at an expanding range of locations, including grocery stores, restaurants, and even vending machines.

The widespread availability of NFC-enabled cards from various issuers further enhances their convenience and usability.

Seamless Integration with Mobile Wallets

NFC-enabled cards seamlessly integrate with mobile wallet apps, enhancing your payment options. This counts as one of the huge benefits of NFC payments. By adding your card to a mobile wallet, such as Apple Pay or Google Pay, you can make contactless payments using your smartphone or wearable device.

It's as simple as tapping your phone on the payment terminal, offering a streamlined and versatile payment experience.

Contactless Travel and Transit

It's astonishing to see how do NFC payments work, enabling contactless travel and transit experiences.

Imagine smoothly tapping your card on a bus or subway turnstile, swiftly accessing transportation without fumbling for exact change or paper tickets. With NFC-enabled cards, your payment card doubles as a convenient travel companion.

Rewards and Loyalty Programs

NFC-enabled cards can integrate seamlessly with rewards and loyalty programs, allowing you to earn points, discounts, or cashback while making contactless payments. Unlocking these benefits adds extra value to your transactions, making every purchase more rewarding.

Get an extra edge over your competitors with our advanced customer loyalty and reward programss.

Speedy Payments

NFC-enabled cards facilitate speedy transactions, minimizing payment processing time. With a simple tap, payments are authorized and processed within seconds, reducing waiting times for both customers and merchants.

This efficiency makes NFC-enabled cards an ideal choice for high-volume environments, such as busy retail stores or quick-service restaurants.

Improved Operational Efficiency

For businesses, NFC-enabled cards offer improved operational efficiency. With faster transactions, reduced cash handling, and simplified payment processing, businesses can enhance their productivity, optimize customer flow, and provide a seamless payment experience.

Impact of NFC-enabled Card Issuance on Contactless Payments

From changing consumer behavior to providing business benefits, these cards have redefined the way we make transactions. Let's delve into the profound impact of NFC-enabled cards on contactless payments, uncovering how it has shaped the payment landscape in numerous ways.

Adoption and Usage Statistics

The adoption of NFC-enabled cards and contactless payments has skyrocketed in recent years. Statistics reveal that millions of people worldwide have embraced the convenience and security offered by these cards. For instance, in 2022 alone, there were over 2.5 billion contactless transactions in the United States, a testament to the growing popularity of NFC-enabled cards.

Changing Consumer Behavior

NFC-enabled card issuance is an advanced payment solution that has transformed consumer behavior, encouraging a shift toward contactless payments. Today, customers prefer the speed and simplicity of tapping their cards rather than handling cash or entering PINs.

The ease of contactless payments has become ingrained in daily routines, fostering a cashless society mindset.

Business Benefits and Cost Savings

Contactless payments bring tangible benefits to businesses. NFC-enabled card issuance reduces payment processing time, enabling faster checkout experiences.

Moreover, businesses can enjoy cost savings by minimizing cash handling and reducing the risk of errors associated with traditional payment methods. This operational efficiency positively impacts the bottom line.

Consumer Trust and Perception

NFC-enabled cards have instilled a sense of trust and security among consumers. The robust security features embedded in these cards, coupled with the convenience of contactless transactions, have bolstered consumer confidence. This trust, in turn, contributes to the wider adoption and acceptance of contactless payments.

COVID-19 Pandemic Influence

The global COVID-19 pandemic catalyzed the accelerated adoption of contactless payments. NFC-enabled cards played a crucial role in promoting touchless transactions, reducing the need for physical contact, and minimizing the spread of germs.

As consumers prioritize safety and hygiene, the pandemic further reinforced the importance of contactless payments and the relevance of NFC-enabled card issuance.

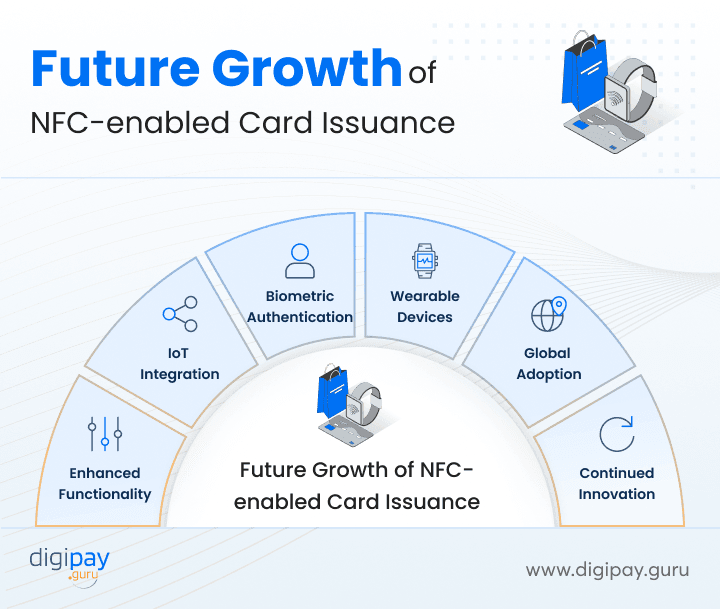

Future Growth of NFC-enabled Card Issuance

Let's delve into the exciting prospects and potential growth of NFC-enabled card issuance, as it continues to reshape the landscape of payments in the years to come.

Enhanced Functionality

The future of NFC-enabled card issuance will witness an expansion of its functionality beyond traditional payment transactions.

These cards will seamlessly integrate with various aspects of our daily lives, becoming multi-purpose devices. Imagine using your NFC-enabled card to access secure buildings, unlock hotel rooms, or even store identification credentials, eliminating the need for multiple cards or documents.

IoT Integration

NFC-enabled cards will further integrate with the Internet of Things (IoT), connecting with a network of smart devices. Picture a world where your card can interact with your smart home, enabling you to make purchases directly from your refrigerator or initiate payments through voice-activated assistants.

The convergence of NFC technology and IoT will open up new avenues for seamless and interconnected experiences.

Biometric Authentication

The future of NFC-enabled card issuance will witness the integration of advanced biometric authentication methods. Fingerprint or facial recognition technology will add an extra layer of security, ensuring that only authorized users can access and use the card.

Also, the use of biometric technology in the banking sector will enhance convenience, and speed, and mitigate the risk of fraud, making NFC-enabled cards even more secure and user-friendly.

Wearable Devices

NFC-enabled card issuance will extend its reach to wearable devices, such as smartwatches, wristbands, and even jewelry. These fashionable and functional accessories will enable users to make contactless payments with a simple flick of the wrist, seamlessly integrating payments into their daily lives.

The convenience and style of wearables will drive the future growth of NFC-enabled card issuance.

Global Adoption

NFC-enabled card issuance will witness increased global adoption, transcending geographical boundaries. As technology becomes more accessible, even in developing economies, contactless payments will become the norm worldwide.

This global acceptance will pave the way for seamless international travel and cross-border transactions, further fueling the growth of NFC-enabled card issuance.

Continued Innovation

The future growth of NFC-enabled card issuance will be fueled by relentless innovation. Technological advancements, collaboration between financial institutions and tech companies, and the ongoing evolution of payment ecosystems will drive the development of more advanced and feature-rich NFC-enabled cards.

This innovation will continually enhance the user experience, making payments faster, smarter, and more secure.

Conclusion

NFC-enabled card issuance has revolutionized contactless payments, offering unparalleled convenience, enhanced security, and seamless transactions.

As we look towards the future of mobile payments, the growth of this technology holds immense potential for NFC and contactless payments, with expanded functionality, IoT integration, biometric authentication, and global adoption on the horizon. To stay ahead in this dynamic payment landscape, businesses must embrace innovative solutions.

At DigiPay.Guru, we offer a cutting-edge NFC payment solution that enables easy and secure contactless payments for your business. Experience the power of NFC technology and unlock a world of frictionless transactions with DigiPay.Guru's NFC payment solution.