Are you a business aiming to drive financial inclusion, increase customer base, or boost profits? If yes, SACCOs can be your strategic partner!

But the problem is, Savings and Credit Cooperative Organizations (SACCOs) are one of the most overlooked yet powerful growth channels in your market. These member-owned cooperatives are the backbone of financial inclusion in Africa.

By 2023, the continent had nearly 24,600 SACCOs that served 17mn members, with a combined savings portfolio of $10.48bn and assets of $8.62bn. This level of scale reflects both trust and real economic opportunity.

For businesses like yours, SACCOs offer much more than social impact. When digitized, they become streamlined distribution networks capable of:

-

Handling payments

-

Disbursing loans

-

Onboarding digitally, and

-

Integrating smoothly into modern payment systems

And if you’re targeting the underserved, boosting transaction volume, or fulfilling inclusion rules, SACCOs are a natural partner with both strategic and financial upside.

Missing this wave means losing out on the next frontier of growth.

But, don’t worry, we have got you covered. This blog explores all about SACCOs, their benefits, working, impact, & more.

Here you go!

What is a SACCO?

A SACCO is a member-owned financial cooperative where members pool their savings together and provide loans to one another at reasonable interest rates.

Unlike a commercial bank, a SACCO’s main purpose isn’t to generate profit for shareholders; it’s to serve the financial needs of its members.

Example: In Kenya, the Kenya Police SACCO serves over 70,000 members. It offers loans at lower interest rates than many banks. Plus, it helps officers and their families fund education, start businesses, and buy homes.

Types of SACCOs

There are 4 main types of SACCOs. They are:

- Community-Based SACCOs

Serve people living in the same geographic area, such as a village, town, or region. They focus on local development and building trust among neighbors.

- Employee-Based SACCOs

Formed by staff from the same organization or sector, offering tailored financial solutions like salary-backed loans and group insurance.

- Investment-Based SACCOs

Centered on pooling funds for joint investments such as real estate projects, farming ventures, or business start-ups.

- Agriculture-Focused SACCOs

Support farmers and agribusinesses with seasonal loans, farm input financing, and market access initiatives.

SACCO Industry Growth Potential

In Africa, SACCO membership has been growing steadily due to trust, accessibility, and cultural fit. And countries like Kenya, Uganda, and Tanzania have vibrant SACCO sectors, with digitization opening the door for even faster growth.

As rural communities gain mobile internet access, SACCOs are positioned to become the bridge between informal savings groups and formal banking systems.

How a Traditional SACCO Works

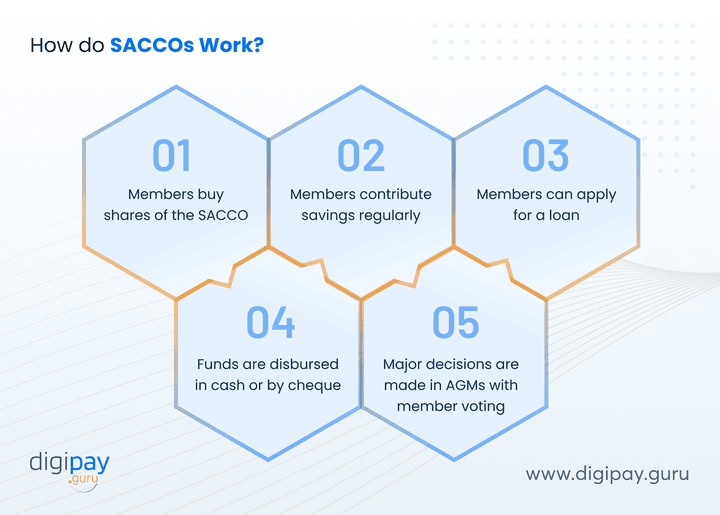

To understand where digitization creates value, it helps to see how a traditional SACCO operates today. Most follow a similar cycle of how saccos work:

Step 1: Membership and Ownership

Anyone who meets the SACCO’s criteria, such as living in a certain area or working in a specific sector, can join. Basically, members buy shares, which makes them part-owners with equal voting rights, regardless of how much they save.

Step 2: Savings Mobilization

Members contribute savings regularly, often monthly. These savings build the SACCO’s capital base and determine the size of loans a member can request.

Step 3: Loan Application and Approval

A member applies for a loan, usually backed by their savings and guarantors from within the SACCO. And then the approval is handled by a credit committee, which often meets only monthly or quarterly.

Step 4: Loan Disbursement and Repayment

Funds are disbursed in cash or by cheque. But, repayments are made manually at SACCO offices or through bank deposits, with records updated by hand.

Step 5: Governance and Decision-Making

Major decisions are made in Annual General Meetings (AGMs) where every member has one vote. And the committees oversee credit, supervisory functions, and management.

SACCO vs Bank

Banks often see SACCOs as basic competitors, but they can be strong allies.

SACCOs excel in local trust and community reach, while banks and fintechs bring technology, compliance, and advanced financial products.

Together, they can deliver more value to underserved markets than either could alone.

Why Members Choose SACCOs Over Other Financial Institutions

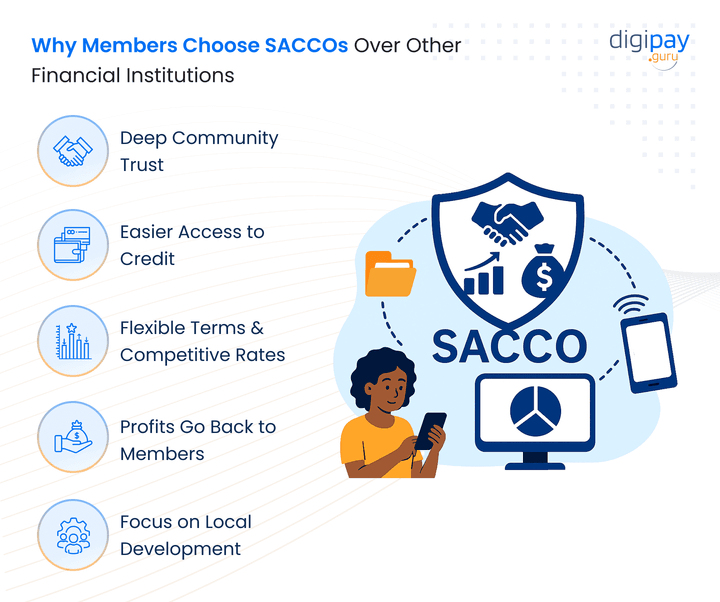

If banks and fintechs offer more products and faster technology, why do millions still prefer SACCOs?

The answer lies in trust, accessibility, and community connection. Understanding this loyalty is key if you want to build partnerships that work.

Here’s why members choose SACCOs:

1. Deep Community Trust

SACCOs are embedded in the communities they serve. And members often know each other personally, and decision-making is transparent. This familiarity creates trust that large financial institutions sometimes struggle to match.

Example: A farmer in rural Uganda may join the local SACCO because the loan committee includes people he has known for years and has a trust built through shared history.

2. Easier Access to Credit

Loans are approved based on member contributions and peer guarantees rather than rigid credit scores. This flexibility makes SACCOs a lifeline for individuals without formal credit histories.

Example: A boda boda (motorbike taxi) rider in Kenya can access financing for a new bike through his SACCO without needing bank collateral.

3. Flexible Terms and Competitive Rates

Because SACCOs are not-for-profit, interest rates here are often lower than those at commercial lenders.

Plus, the repayment schedules can be tailored to seasonal or irregular incomes. Such a level of flexibility makes members feel less pressured.

4. Profits Go Back to Members

If there’s any surplus, it's shared among members as dividends or reinvested into better services. This “ownership dividend” creates loyalty and keeps members engaged.

5. Focus on Local Development

SACCOs provide loans that often fund projects that benefit the entire community, from small businesses to education.

This shared prosperity strengthens the SACCO’s role as a driver of local growth.

All the above points show why SACCO members are highly engaged and why integrating with SACCOs can deliver loyal, transaction-ready customers for your business.

So, you need to act fast to leverage the benefits.

Challenges Faced by Traditional SACCOs

While SACCOs have strong community trust, their traditional operating models limit their growth and efficiency.

For financial institutions like yours who are looking to partner with SACCOs, understanding these gaps is key because each challenge is also a market opportunity.

They are:

1. Manual Operations and Record-Keeping

Many SACCOs still rely on paper ledgers or basic spreadsheets. This slows service delivery, increases human error, and makes it harder to track transactions in real time.

2. Limited Geographic Reach

SACCO members often have to travel to physical offices to deposit savings, repay loans, or attend meetings. This limits growth potential and reduces convenience for rural or mobile populations.

3. Weak Data Management and Credit Scoring

Without digital systems, SACCOs struggle to maintain accurate member records or generate reliable credit histories. This limits their ability to offer tailored loan products or expand lending capacity.

4. Fraud and Transparency Risks

There is a possibility of fraud, mismanagement, or data manipulation where there are cash-heavy transactions and manual approvals. This, in turn, can lead to a decrease in trust if issues arise.

5. Compliance and Regulatory Pressure

As governments tighten financial regulations, SACCOs without digital reporting tools face difficulties in meeting compliance requirements efficiently. This can lead to heavy fines and penalties.

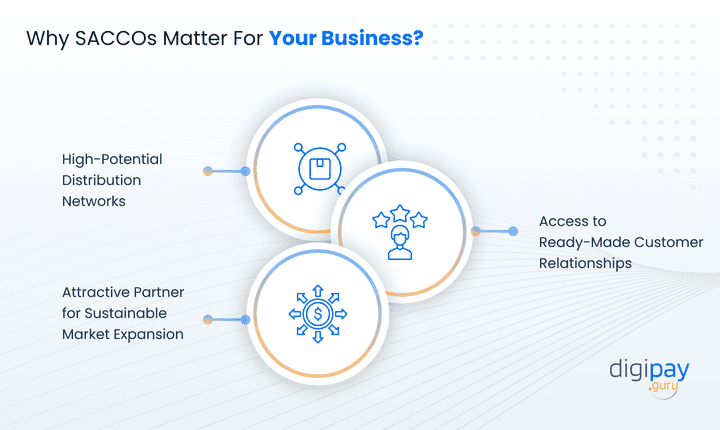

Why SACCOs Matter to Banks, Fintechs, and Financial Institutions

For businesses like yours, SACCOs are more than community cooperatives. They’re high-potential distribution networks for financial products and services.

And their deep community trust, loyal membership base, and growing transaction volumes make them an attractive partner for sustainable market expansion.

By partnering with SACCOs, you gain access to ready-made customer relationships in markets that are otherwise expensive and time-consuming to penetrate.

And when SACCOs are digitized, this potential offers

-

New products

-

Higher transaction volumes

-

And faster onboarding

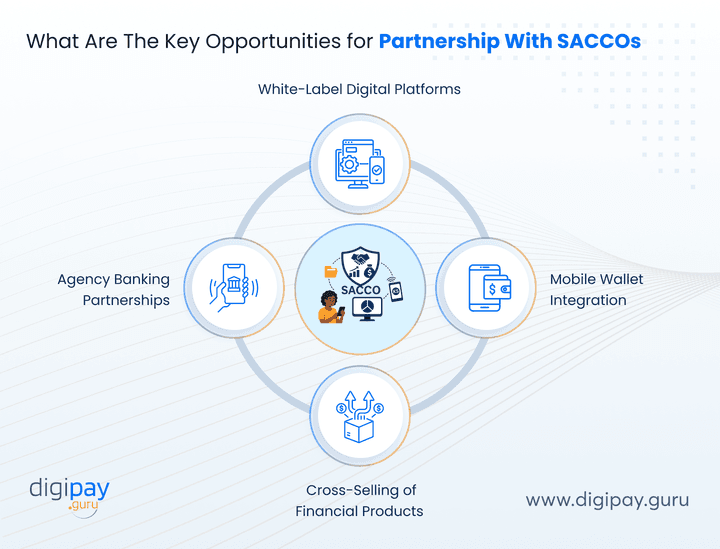

Key Partnership Opportunities

The key partnership opportunities that SACCOs

1. White-Label Digital Platforms

Offer SACCO-branded mobile and online banking platforms powered by your infrastructure. This lets SACCOs keep their identity while giving you transaction volume and fee revenue.

2. Agency Banking Partnerships

Enable SACCO branches to act as banking agents. This extends your physical reach into rural areas without the cost of building branches.

3. Mobile Wallet Integration

Link SACCO accounts to your mobile money ecosystem. Here, members can transact instantly while you benefit from increased payment activity.

4. Cross-Selling of Financial Products

Use SACCO networks to offer insurance, remittances, or microloans to an already engaged customer base. This boosts revenue while deepening customer relationships.

The Impact of Digitization on SACCOs

Digitization is not just a technology upgrade for SACCOs; it’s a complete shift in how they operate, serve members, and grow.

For financial businesses like yours, it turns SACCOs from small-scale cooperatives into scalable & data-driven partners capable of handling high transaction volumes and integrating seamlessly with modern financial systems.

From Manual to Digital: The Transformation

Traditionally, SACCOs relied on physical branches, paper ledgers, and face-to-face transactions. This limited their reach, slowed service delivery, and left gaps in transparency.

Digitization removes these barriers by enabling:

-

24/7 account access through mobile and online banking.

-

Real-time transaction tracking for faster & more accurate reporting.

-

Automated processes that reduce human error and fraud risk.

Key Digitization Trends To Implement for SACCOs

To unlock the full potential of SACCO partnerships, it’s not enough to simply “go digital.”

The real impact comes from adopting specific, high-value technologies that:

-

Enhance operations

-

Improve member experience, and

-

Create new revenue streams for SACCO & its financial partners

The key SACCO industry trends you can implement are:

1. Mobile & Online Banking

Allows members to check balances, transfer funds, and apply for loans anytime, anywhere, thereby eliminating the need for physical visits.

2. e-Wallet Integration

Links SACCO accounts to digital payment platforms, which enables cashless transactions and participation in broader payment ecosystems.

3. Agency Banking Systems

Empowers SACCO branches and agents to offer core banking services locally, while expanding reach without heavy infrastructure investment.

4. Merchant Acquiring

Equips SACCO members who run businesses to accept digital payments. This drives adoption and transaction volumes.

5. eKYC & Digital Onboarding

Speeds up new member registration while ensuring regulatory compliance and reducing identity fraud.

How Banks and Fintechs Can Drive SACCO Digitization

Digitizing a SACCO is about creating a strategic growth partnership where both sides benefit.

Banks and fintechs like yours have the infrastructure, compliance expertise, and product range that SACCOs need to modernize.

In return, SACCOs provide a loyal customer base and deep market access.

1. Co-Develop Tailored Digital Solutions

Work with SACCO leadership to design platforms that match their unique workflows, regulatory environment, and member needs. This builds trust and increases adoption.

2. Enable Seamless API Integration

Connect SACCO systems directly to your banking or fintech infrastructure. This enables instant payments, real-time reporting, and product cross-selling without operational friction.

3. Expand Reach Through Agency Banking Models

Empower SACCO offices and agents to act as service points for your business. This offers deposits, withdrawals, bill payments, and loan disbursements under your brand.

4. Offer Embedded Financial Products

Use SACCO channels to distribute microloans, insurance, remittances, and merchant services. This not only generates revenue but also strengthens SACCO's value proposition.

5. Provide Training and Capacity Building

Equip SACCO staff with the skills to manage new technology, ensure compliance, and deliver a better customer experience. This reduces resistance to change and improves long-term success.

Future of SACCOs in a Digital Economy

As SACCOs evolve, their future lies in becoming tech-driven financial hubs that empower underserved communities and offer a base for banks and fintechs aiming for meaningful growth.

And ready-to-go digital channels are already reshaping SACCO service delivery.

According to the FinAccess Household Survey 2024, 98.9% of SACCO members in Kenya now prefer digital channels like mobile apps and agency banking over visiting physical branches.

Key Trends That Will Shape Tomorrow’s SACCO

- AI and Data Analytics

AI transforms SACCOs into smarter, more agile lenders with predictive credit scoring, member behavior insights, and personalized financial offers.

- Blockchain for Trust and Transparency

These are immutable ledgers that prevent tampering, reduce fraud, and strengthen member confidence, which is a vital upgrade for record-keeping.

- Sustainable, Inclusive Business Models

SACCOs are repositioning as agents of socio-economic uplift by investing in renewable energy, local development, and preservation of cooperative values.

- Regulatory and Institutional Support

In markets like Kenya, regulators are enabling SACCO digitization through shared platforms and digital frameworks. This transforms a sector-wide movement, not just an isolated effort.

DigiPay.Guru’s Solution for Digitizing the SACCO Model

Digitizing a SACCO is not just about adding technology. It’s about creating a connected ecosystem where members, management, and partners operate in real time, securely and efficiently.

DigiPay.Guru delivers exactly that.

We provide end-to-end digital solutions tailored to the SACCO model, designed to improve operations, boost transaction volumes, and open new revenue streams for both SACCOs and its financial partners.

Our Core Solutions for SACCO Digitization include:

1. e-Wallet & Mobile Money Platform

Enable members to deposit, withdraw, transfer funds, and repay loans 24/7 without visiting a branch.

2. Agency Banking Software

Turn SACCO branches and partner outlets into service points, thereby expanding reach without heavy infrastructure investment.

3. Merchant Acquiring

Equip SACCO members who run businesses with the ability to accept digital payments. This will drive adoption and local commerce.

4. eKYC & Digital Onboarding

Digitally verify members, streamline account opening, and stay compliant with regulations while reducing onboarding time from days to minutes.

5. Seamless API Integrations

Connect SACCO systems with banks, payment processors, and fintech platforms for real-time transactions and reporting.

With DigiPay.Guru, SACCOs can move beyond traditional boundaries and operate like modern & agile financial institutions.

While businesses like yours gain loyal customers, higher transaction throughput, and faster market entry.

Conclusion

Across towns, farms, and workplaces, SACCOs have been quietly powering financial inclusion for decades. They’re trusted, community-led, and deeply rooted where traditional banking often struggles to reach.

For banks, fintechs, and other financial institutions like yours, they’re more than community organizations. They are the pathway to engaged customers, steady deposits, and untapped lending opportunities.

SACCOs already have the trust, the networks, and the loyal customers. What they need is the technology, speed, and compliance framework that you can provide.

This is possible to achieve with digitization.

It turns SACCOs into agile, data-driven partners capable of moving money, approving loans, and serving members in real time. And for you, it means entering new markets faster, at lower cost, with customers who are already engaged.

So, what are you still waiting for? Implement DigiPay.Guru’s advanced solutions in your payment platform and create a solution with your business & SACCO partnership. Boost profits, increase customer base, and stay ahead of the competition.

FAQ's

A Savings and Credit Cooperative Organization (SACCO) is a member-owned financial cooperative where individuals pool their savings to provide loans and other financial services to each other.

SACCOs operate on a not-for-profit basis, meaning their primary goal is to benefit members, not external shareholders. In many African markets, SACCOs are key drivers of financial inclusion, serving communities where traditional banks have limited reach.

While both provide savings, loans, and financial services, the ownership and mission set them apart. A bank is owned by shareholders and focuses on profit, while a SACCO is owned by its members and focuses on member benefits.

SACCOs often have simpler loan qualification processes, stronger local trust, and closer community ties. Banks and SACCOs can complement each other: SACCOs bring reach and relationships, while banks bring infrastructure and advanced products.

SACCO members are highly engaged and loyal because they’re both customers and part-owners. This means they are more likely to use services regularly and trust the institution.

For financial partners, this loyalty translates into stable transaction volumes, cross-selling opportunities, and a lower cost of customer acquisition in markets that are typically expensive to penetrate.

Traditional SACCOs rely on manual processes that limit speed, reach, and transparency. Digitization enables 24/7 service access, real-time reporting, automated loan approvals, mobile payments, and compliance readiness. For partners, a digitized SACCO means faster transactions, better data for decision-making, and easier integration into wider payment ecosystems.

DigiPay.Guru uses bank-grade security measures including data encryption, secure APIs, multi-factor authentication, and compliance with global and regional financial regulations. We also offer role-based access controls, regular security audits, and fraud detection features, which ensure that SACCO transactions and member data are fully protected.

The timeline depends on the SACCO’s size, existing systems, and desired features. On average, our deployments range from 4 to 12 weeks. We manage the entire process, from needs assessment and customization to training and launch, to ensure a smooth and disruption-free transition.

We go beyond technology installation. DigiPay.Guru equips SACCOs with scalable platforms, integration with mobile money and banking systems, AI-ready data infrastructure, and future-proof compliance features. This positions them to adopt emerging technologies, expand services, and remain competitive as member expectations and regulations evolve.