With digital wallets becoming the norm of online payments, it has changed how your customers handle money. And your customers want more control, more clarity, and more flexibility in how they manage their finances.

They don’t want a single bucket of funds anymore. They want structure inside their wallet. Plus, they want clarity without complexity. And that is exactly where sub wallets step in.

According to Juniper Research, over 5 billion people are expected to use digital wallets by 2026. With that kind of scale, you cannot afford a “one-size-fits-all” wallet.

Your customers expect wallets that help them budget, plan, save, track, and stay in control without downloading five different apps. A sub wallet gives them that.

It allows them to create smaller, purpose-driven sections inside their main wallet. Each section can have its own rules, limits, and goals. For you as a bank, fintech, or financial institution, this brings better user engagement, higher retention, and stronger product value.

This blog breaks down:

- What is Subwallets & their Types

- Why Customers & Businesses Need Sub-Wallets

- How Sub-Wallets Work in an eWallet System

- Why DigiPay.Guru Can Help & More

Let’s get started!

What Are Sub-Wallets?

A sub-wallet is a smaller wallet created inside the main wallet. You can think of it as a dedicated pocket inside a larger wallet. Each pocket has its own balance, purpose, and controls.

With it:

- Your customers get more structure.

- Your platform gets more activity.

And when you offer sub wallets, users can save for goals, assign spending limits, manage categories, hold different currencies, store rewards, and control how funds flow inside your ecosystem.

In simple terms:

Sub wallet meaning → A dedicated wallet inside the main wallet, created for a specific purpose.

Some people even search for SubWallet app, thinking it is a separate tool. But this feature lives inside a digital wallet or eWallet system.

And if you're a bank or fintech, offering a single wallet with multiple sub-wallets gives your customers a level of financial clarity they rarely get today.

Split payment, Schedule payment, Sub Wallets: The advanced features of digital wallet

How Sub-Wallets Work

Sub-wallets work on a simple idea. You give users one main wallet and then allow them to create smaller “money buckets” inside it for different purposes.

Each bucket holds real value. Each bucket carries its own rules. And each bucket helps the user keep funds organised without opening multiple accounts.

At a system level, the flow stays clean. The main wallet remains the parent account. The sub-wallets sit under it as controlled containers.

The user can move money between them instantly. Every transfer is tracked. Every event is logged. And every wallet follows its own spend limits and permissions.

Here’s how sub wallets works in your eWallet platform:

- The user creates a sub-wallet for travel, bills, savings, or family use.

- The platform assigns a unique ID to that sub-wallet for tracking and compliance.

- The user moves funds from the main wallet into the sub-wallet.

- Rules apply automatically: limits, merchant restrictions, or auto-top-ups.

- Transactions route from the sub-wallet, not the main one, so accounting stays accurate.

- You get real-time visibility into balances, spending, and usage patterns.

This structure gives your platform predictable fund flow, clearer compliance control, and a far better user experience.

Types of Sub-wallets

Before you offer sub-wallets to your customers, it helps to understand the different ways they can be structured. Each type solves a specific financial need, and together, they open up a wide range of digital wallet use-cases.

Below is a clear breakdown of types of sub wallets to help you see which model fits your product vision.

| Sub-Wallet Type | Purpose / Use-case | Key Features | Example Use Cases |

|---|---|---|---|

| Category Wallets | Budgeting by category | Limit-setting, auto-allocations | Travel, Shopping, Emergencies |

| Parent-Child Wallets | Family money management | Parental control, tasks | Pocket money, allowance |

| Multi-Currency Wallets | Holding/Spending in various currencies | Currency exchange, FX management | Travel, Cross-border business |

| Savings Wallets | Goal-based savings | Milestones, interest, auto top-up | Car, House, Emergency Fund |

| Billing Sub-Wallets | Recurring bills | Scheduled payments, auto-refill | Utility payments, Rent |

| Promotion / Gift Wallets | Reward credits | Merchant-locked, time-limited funds | Cashback, Gift cards |

| Internal Benefit Wallets | Employer or platform funded | Restricted spend, pre-defined merchants | Employee benefits, marketplace credits |

Difference Between Wallet and Sub Wallet

A wallet is the user’s primary store of value. It holds the full balance, manages KYC, controls limits, and acts as the main account for all transactions.

A sub-wallet, on the other hand, is a smaller, purpose-specific section inside that main wallet. It carries its own balance and rules but cannot exist independently.

For example: the main wallet is like a “bank account” and each sub-wallet is a labelled envelope used for budgeting.

The wallet gives access, permissions, and compliance, while each sub-wallet gives structure, spending control, and clarity.

This difference helps users stay organised and helps you offer richer, more personalised financial experiences without adding operational complexity.

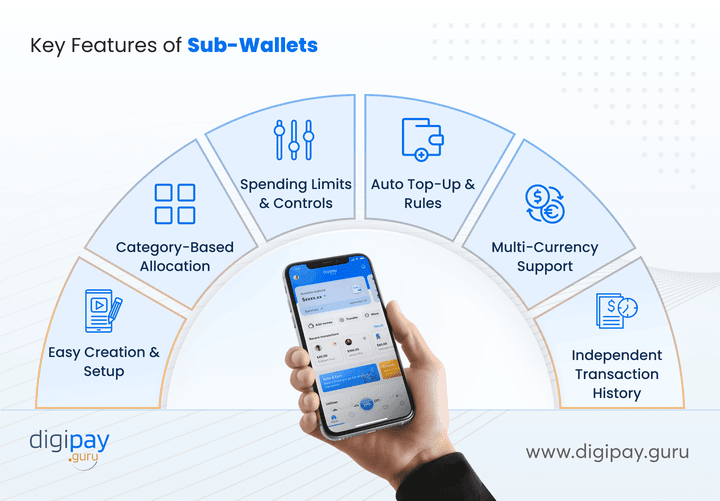

Key Features of Sub-Wallets (To Build Into Your Digital Wallet)

Sub-wallets work best when they’re simple to use and easy to manage. As a bank or fintech, you want features that improve user adoption, reduce friction, and create daily engagement.

The following sub wallets features help you deliver sub-wallets that feel practical, intuitive, and genuinely useful.

They are:

Easy Creation & Setup

Your users should be able to create a new sub-wallet in seconds. Clear labels, simple onboarding steps, and preset categories help them get started fast. Plus, when setup feels effortless, adoption rises naturally, and you avoid drop-offs.

Category-Based Allocation

You can assign spending types such as bills, groceries, travel, or fuel. These fixed categories help users see where their money goes. They also simplify analysis for your institution and enable better personalisation.

Spending Limits & Controls

Sub-wallets let you set transaction caps or daily limits. This protects users from overspending and helps families or teams control shared budgets. You can even block merchants or restrict certain categories.

Auto Top-Up & Rules

Users can schedule recurring transfers or percentage-based allocations. Auto top-ups encourage consistency, especially for savings or bill-based sub-wallets. This increases retention because users rely on your app to stay organised.

Multi-Currency Support

With multi-currency sub-wallets, travellers, freelancers, or expats can hold funds in different currencies. This reduces FX fees, supports cross-border payments, and unlocks high-value use cases for your institution.

Independent Transaction History

Each sub-wallet stores its own history. Users instantly understand where the money went without filtering through the entire wallet. This clarity builds trust and reduces dependency on customer support.

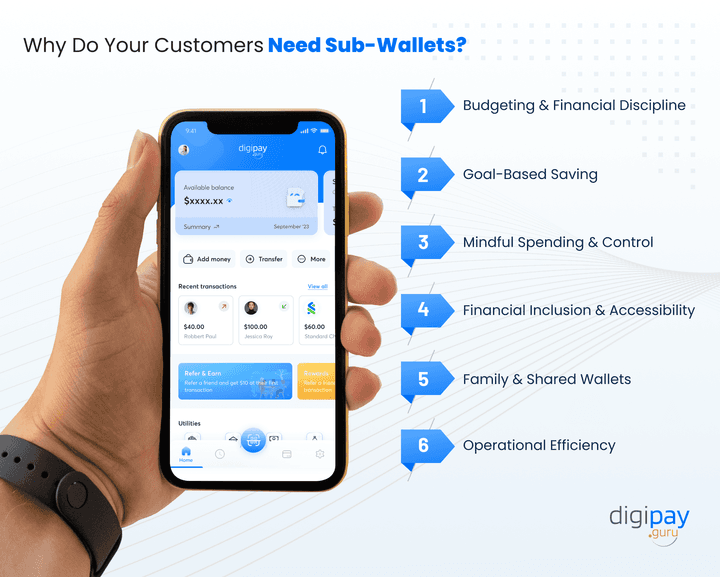

Why Do Your Customers Need Sub-Wallets?

Sub-wallets solve real problems for customers. They help them plan, control spending, and build better financial habits.

Here are the most important benefits for end-users.

Budgeting & Financial Discipline

Your customers want clarity about their expenses. And sub-wallets help them organize money based on categories. These wallets allow your customers to create pots or sub-wallets with different fund capacities and different goals on an ongoing basis.

With it:

- It becomes easier to track spending

- It reduces confusion, and

- They avoid mixing bills with personal purchases

Goal-Based Saving

With the help of sub-wallets, your customers can easily achieve their savings milestones, such as saving 2500 dollars before launching a new product and saving 5000 dollars for marketing needs for the next quarter.

Setting the saving milestones makes them feel more secure about their future goals.

This keeps savings visible and motivates progress. And you help them build healthy financial habits

Mindful Spending & Control

The sub-wallets, with their storage, saving, and limited spending features, help your customers to be mindful of their spending. They can set budgets of spending for shopping, food, or entertainment

Once the limit is reached, the wallet stops. This creates financial awareness.

Financial Inclusion & Accessibility

Users new to digital wallets/eWallets find sub-wallets simple to understand.

- They can start with small budgets.

- They can separate funds.

- They feel more in control.

Family & Shared Wallets

Parents can set up child wallets with spending controls. This teaches kids discipline. It also prevents misuse and helps families manage money better.

Operational Efficiency (for Users)

With sub-wallets, money is structured. And so bills, savings, and expenses stay organized. This removes manual tracking and reduces stress.

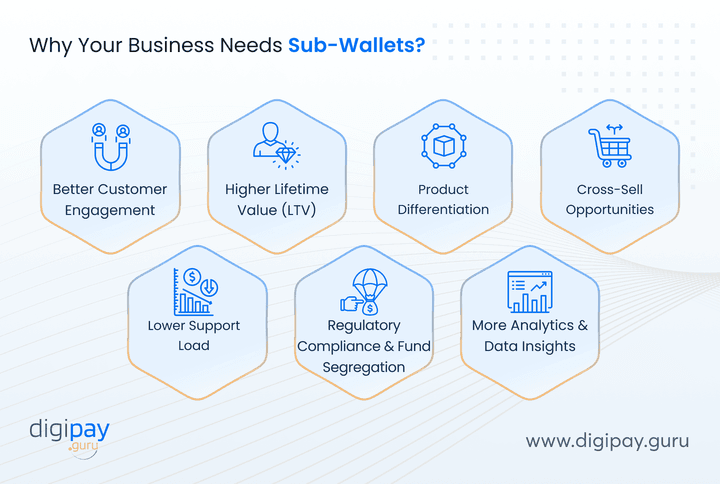

Why Your Business Needs Sub-Wallets (Banks, Fintechs & Institutions)

Sub-wallets are not only useful for your end-customers. They create strong business advantages for you as a bank, fintech, or financial institution.

Here’s why you need it in your eWallet strategy:

Better Customer Engagement: Users interact with your wallet more often when it feels practical. Sub-wallets increase app opens and retention. Plus, they drive long-term loyalty.

Higher Lifetime Value (LTV): Customers who use budgeting, savings, and spending tools stay longer. Plus, they keep more money in their wallets. This increases your average balance and overall revenue potential.

Product Differentiation: Sub-wallets set your wallet apart from competitors. You offer structure that others do not. This strengthens your market positioning.

Cross-Sell Opportunities: When your users separate funds, you understand their preferences better. This way, you can recommend the right savings product, loan, insurance, or merchant deals.

Lower Support Load: When finances are clearly separated, your customers ask fewer questions. There are fewer disputes. And your support teams operate more efficiently.

Regulatory Compliance & Fund Segregation: For certain regions, segregated funds simplify compliance. You avoid mixing bill money with general spending. And you also support employer-funded or restricted-spend wallets.

More Analytics & Data Insights: With subwallets, you get visibility into how users spend, save, and plan. This helps you build smarter features over time.

Why DigiPay.Guru Is the Ideal Partner for Sub-Wallet Capabilities

Leading financial businesses choose DigiPay.Guru because you don’t just get a sub-wallet feature. You also get the complete foundation needed to launch, scale, and manage a modern digital wallet ecosystem.

Plus, every capability is built for high-volume environments, strict compliance needs, and diverse global use-cases.

DigiPay.Guru combines deep domain experience, modular architecture, and enterprise-grade security to help you launch sub-wallets that work smoothly for retail customers, SMEs, agents, and cross-border users.

Here’s what makes DigiPay.Guru the stronger choice:

- Modular wallet architecture supporting category-wallets, multi-currency wallets, goal-wallets, corporate wallets, and more

- Real-time fund flow engine with configurable controls, limits, and automated rules

- Advanced compliance stack with PCI SSF, AML screening, eKYC, risk scoring, and transaction monitoring

- Cross-border ready with corridor management, FX handling, and routing

- White-label, API-first framework for fast integration and full branding flexibility

- Proven track record across Africa, Asia, the Caribbean, and MENA

DigiPay.Guru helps you launch faster, scale confidently, and deliver value that keeps customers active across every wallet segment.

Conclusion

Sub-wallets have moved from a simple feature to a practical way for people to manage money with clarity and control.

Users want tools that help them organise spending, build savings, and track goals without friction.

Research shows that digital wallet users engage 35–45% more when they have built-in budgeting and category-based money management. That means your platform is more likely to stay part of their daily financial routine.

For businesses like yours, sub-wallets create stronger engagement, deeper customer insight, and better product stickiness. They open the door to new revenue models, smarter segmentation, and more meaningful customer interactions.

Most importantly, they help you offer a wallet that genuinely supports your users’ financial lives.

If you want to deliver a wallet experience that feels modern, thoughtful, and built for real-world money habits, DigiPay.Guru can help.

Our eWallet platform gives you ready-to-launch sub-wallet capabilities, multi-currency support, strong security, and modular flexibility so you can create a product your customers will actually use every day. Let’s build a smarter wallet together.

FAQs

A sub-wallet is a smaller wallet created inside a main digital wallet. It helps users separate money for specific goals, categories, or tasks. Your customers can save, spend, or track funds without mixing it with the main balance. Businesses like yours use it to offer better control and personalised financial experiences.

A main wallet stores the user’s primary balance. A sub-wallet stores funds for specific needs, such as savings goals or categories. The main wallet funds the sub-wallet, and the user controls how much they move. Both work together but serve different purposes.

Yes. Users can create multiple sub-wallets based on their goals or spending habits. They can have one for travel, one for bills, one for savings, and more. Banks and fintechs like yours can set limits or allow customers to create unlimited sub-wallets, depending on policy.

Yes. Sub-wallets follow the same security standards as the main wallet. Features such as encryption, transaction limits, KYC, and access controls protect every sub-wallet. You can also add extra rules for high-value or restricted sub-wallets.

Yes, if the platform supports multi-currency wallets. Each sub-wallet can store a different currency, allowing users to spend or save without manual conversion. This helps travellers, expatriates, and cross-border users manage money easily.

You choose a goal, create a sub-wallet for it, and move money into it regularly. Some platforms also allow auto-top-ups to grow savings faster. You track progress separately, which keeps you disciplined and reduces impulse spending.

Businesses can improve user engagement by offering personalised money management. They can enable corporate expense controls, staff allowance modules, reward wallets, or category-based spending. Sub-wallets also help collect better spending data, which supports product improvement and targeted services.

Sub-wallets remain compliant as long as they follow the same KYC, AML, and fund-segregation rules as the main wallet. Risks arise only if limits, identity checks, or monitoring are ignored. A structured wallet platform helps ensure every sub-wallet stays within the regulatory framework.