Quick Summary

Are you looking to implement contactless payment into your business? And did you know that the most popular contactless payment is NFC? This blog will help you explore everything about NFC payments. From what it is and how it works to where it is used to its benefits, and more, we have covered everything that you must know.

99% of smartphones will be capable of making contactless payments globally by 2027.

It means contactless payments are showing a tremendous increase. And NFC payments among them have gained next-level popularity. Customers love to make payments without having to come in direct contact. Plus, it saves time and the struggle to carry cash or wallet anytime your customers go out and make payments.

Businesses like yours can leverage this payment method to attract more customers and increase profits. And, remember that customers want convenience & speed which NFC payment offers in every way.

But, before you go and implement the NFC payment method into your business ecosystem, you need to have complete knowledge of what you are offering your customers and why you need them.

This blog will help you gain insights into all about NFC contactless payments from what it is, to how it works, what devices it supports, business use cases, benefits, drawbacks, security features, and more.

Ready to learn? Let’s get going!

What is NFC mobile payment?

NFC stands for near-field communications. And NFC payment is a contactless payment system that allows users to make transactions by holding their NFC-enabled card or mobile device, close to an NFC reader at a point of sale.

NFC payment system communicates with the payment terminal wirelessly over a short distance (usually 4 cm) using its technology. The aim is to secure the transmission of users' payment information so that they can make payments instantaneously.

Reasons to consider NFC contactless payments

Adopting NFC and contactless payments offers numerous benefits for both businesses and customers:

Enhanced customer experience: Faster checkouts with a simple tap mean happy and returning customers.

Boosts loyalty: Offering modern payment methods positions your business as tech-forward which attracts tech-savvy customers.

Improved security: Advanced encryption protects sensitive data, which reduces fraud risks.

Increased efficiency: Say goodbye to handling cash or manually processing card transactions, thereby increasing operational efficiency

How does NFC mobile payments work?

When both reader and payment devices are close together and activated, the exchange of encrypted payment data from both the NFC chips takes place, which completes the transaction.

This process makes the checkout lightning-fast, thus making NFC mobile payments one of the most secure and convenient payment methods. That’s the reason why NFC-powered payments in apps such as Android Pay and Apple Pay are becoming a preferred payment option.

Now, let’s understand how NFC payments work for your customers, as well as your business:

How your customers can make payments via NFC Smartphone?

As a business, you must be aware of how customers can pay via NFC Phone. So that you can guide the new NFC users and stay aware of the features and updates in the same.

To make an NFC payment as a customer, the user will need a compatible smartphone or a card and a merchant that accepts NFC payments. To pay with NFC a user needs to:

- Look for the NFC symbol at the point of sale or ask the merchant about the same.

- Open their mobile wallet app, such as Google Pay or Apple Pay, on the smartphone or use the card NFC to pay method. In the case of a smartphone, make sure that NFC is turned on.

- The user needs to hold his smartphone or card close to the NFC reader. The device should be within a few inches (4 cm) of the reader for the payment to be successful.

- The payment will be processed within a few seconds.

- Payment is made successfully.

How your business can accept payments via NFC?

NFC mobile payments are beneficial for your business as it allows you to accept customer payments quickly without the need for cash changes or card swipes for payments.

As a business, to accept NFC contactless payments, you need to follow the steps mentioned below:

- Choose the right payment processor.

- Find a suitable NFC-enabled POS.

- Install the POS into your store/shop/business premises.

- Connect POS to the internet.

- Set up a merchant account payment acceptance.

- Start accepting the payments.

When a user makes a payment using an NFC-enabled mobile device, he brings the phone closer, and the purchase amount gets deducted from their account and directly settles into the merchant's account.

Are NFC payments secure?

When it comes to accepting new payment technologies, security is often a top concern for businesses. Fortunately, NFC payments utilize a variety of measures to provide enhanced security and protect consumer data.

- Tokenization replaces card numbers with randomly generated tokens so actual account details are never exposed. This prevents fraud if data is intercepted.

- Short read ranges of just a few centimeters limit potential data skimming and man-in-the-middle attacks.

- Biometric authentication via fingerprint or facial recognition adds another layer of verification on most mobile wallets

- End-to-end encryption protects transaction data as it travels between the terminal, processor, and issuer networks.

- Consumer devices can be remotely locked or wiped if lost or stolen to deactivate mobile wallets.

- EMV chip technology on contactless cards generates unique security codes for each transaction.

The combination of tokenization, encryption, biometrics, and other measures makes NFC payments extremely secure for both consumers and merchants accepting them.

Addressing safety concerns with mobile payments

The two major safety concerns with NFC mobile payments are:

1. How safe is NFC payment?: Extremely safe when paired with trusted apps and devices.

2. Can data be stolen during a tap?: No, as NFC operates within a limited range and uses multiple layers of encryption.

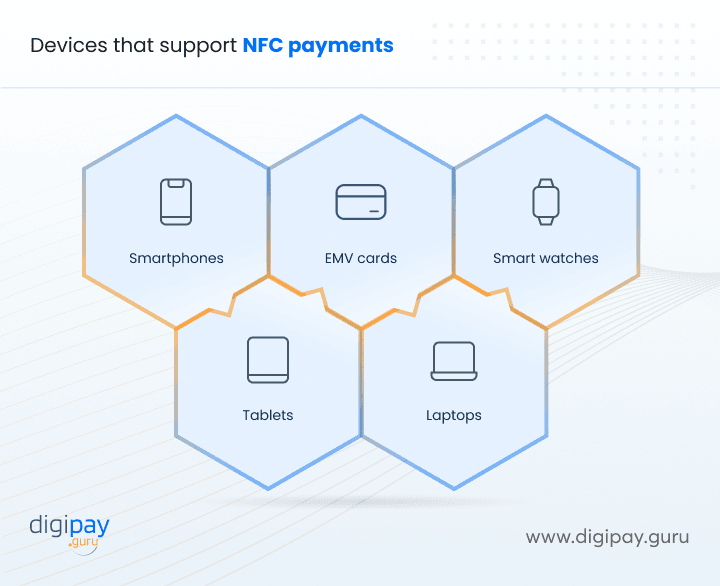

Devices that support NFC payments

It is paramount to install a near-field communications based POS solution or an advanced mPOS solution to start accepting NFC payments. Moreover, businesses like you can accept NFC contactless payments through a limited set of devices used by customers. These devices include:

Smartphones: Smartphones are the most common device used to make NFC payments. These payments are done through a wallet app with an NFC feature in it. For example, Apple Pay, Google Pay, and Samsung Pay.

EMV Cards: Almost all credit and debit cards have an EMV chip supporting NFC in them. This is the second most used NFC payment mode.

Smartwatches: Smartwatches have become quite popular wearables in NFC payments in the last couple of years. For example, Apple Watch and Google Wear OS Watch.

Tablets: Just like smartphones, tablets can also perform NFC payments. For example, iPad Pro, Google Pixel Slate, and Lenovo Thinkpad.

Laptops: Some laptops come with in-built NFC features to accept payments and other laptops that can be used by connecting to an NFC-enabled card or device. Some examples of laptops to make NFC payments are the Microsoft Surface, Asus Expertbook, and HP Elite Dragonfly.

Leading NFC payment apps

Some leading NFC mobile payments apps in the contactless payment system are as under:

Apple Pay

Apple Pay allows iPhone users to upload cards to the Wallet app and pay by holding their phones near supported payment terminals. Transactions made with this app are secured via Face ID or Touch ID.

Google Pay

Google Pay enables Android users to store payment methods and pay with their phones using NFC payments. Transactions via Google Pay are authenticated quickly via the user's screen lock method. It is one of the best NFC payment apps.

Samsung Pay

Samsung Pay comes preloaded on new Galaxy devices and stores card information to allow NFC contactless payments. It uses tokenization and Samsung Knox technology for enhanced security.

Other NFC Apps

Many banks, card issuers, and fintech companies now offer NFC payment apps for mobile payments as well, which provides the users with more choice. Plus, supporting multiple apps ensures customers can pay with their preferred option.

What are the pros and cons of accepting NFC payments?

Accepting NFC payments can have its pros and cons. Weighing them together can make you understand if you should implement NFC payment in your business or not.

Let’s look at the pros and cons of accepting NFC payments:

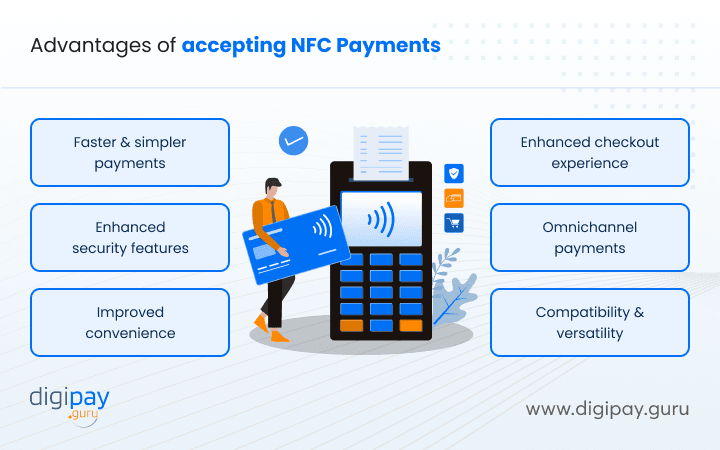

Advantages of accepting NFC payments

Now that you have a basic understanding of what NFC payments are, how they work, the devices they support, and the best NFC payment app. It is time to know the major benefits of accepting NFC payments as a business!

Faster and simpler payments

Compared to payments made by cash, chip, PIN cards, or other digital payment solutions, NFC payment systems are a lot faster.

It’s because of the simplicity of payment where the user has to just tap the NFC card or place the NFC-powered smartphone near the reader and payment is done, just like that.

Moreover, it is also the most popular merchant payment solution as it is convenient and easy to use & implement for the merchant. They don’t have to wait for their customers to enter their PIN or look for change.

With NFC technology, the user can make payments within seconds. And the merchant receives payments directly into their account.

Enhanced security features

Using NFC-enabled mobile wallets is a more secure option than carrying physical cards. It’s because digital ewallet apps like Apple Pay encrypt users’ bank details into tokens that can’t be accessed or manipulated by fraudsters.

So, even if their mobile phone gets stolen, all their credit/debit cards and other sensitive details stay protected. In addition, as these tokens change for every NFC transaction, it is nearly impossible to decrypt them.

These NFC payment apps also come with fingerprint technology which adds an extra layer of security to the NFC payments to save the user from fraud.

Improved convenience

One of the greatest advantages of near-field communications payments is convenience. NFC technology has made it super-easy for users to make payments via their smartphones.

This payment process also eliminates the use of physical cash or cards. With this, the user can make transactions with a simple touch or a few taps on the smartphone.

Also, merchants can smoothly receive payments in their account without the hassle or extra effort of card swiping or extra processing time.

Enhanced checkout experience

Long lines at a store can frustrate the customers. And they might leave without purchasing anything. Plus, if a shopper finds long queues every time he visits the stores, he might label the store as crowded and prefer to shop from somewhere else.

NFC technology can boost the speed of the checkout process for all customers through its short-distance automatic payment system. This makes the queues shorter and enhances the experience for both store owners and customers.

Omnichannel payments : NFC in Banking

NFC payment in Banking allows you to accept NFC tap and pay transactions across multiple sales channels. Whether your customers check out in-store, via your NFC mobile app, on your website, or even at pop-up shop events, they can use this payment method via their mobile wallet app.

This omnichannel banking approach creates a seamless payment experience that aligns with how consumers make payments today across many touchpoints.

Compatibility and versatility

You can accept all the top mobile wallet apps like Apple Pay, Google Pay, and Samsung Pay as well as contactless card transactions. You won’t be tied to just one payment provider or method.

Most new POS systems and terminals have NFC hardware built-in or available as a simple addon. Customers can tap and checkout effortlessly, regardless of which smartphone, wearable, or contactless card they prefer to use.

Supporting multiple payment streams boosts flexibility as consumer preferences evolve. Whether they want to pay with their iPhone, Android watch, or contactless Visa card, you would be able to facilitate the transaction seamlessly.

Some drawbacks of NFC payments

Yes, NFC payments are the best to add to your business to multiply your customer base and revenue. But, there are some drawbacks too. They are

Infrastructure requirements

NFC technology comes with a cost of installing an NFC reader. And the POS system is very costly to afford for some companies, especially new startups or small businesses.

For example, a big company like Starbucks has successfully integrated NFC technology into its NFC mobile app. But, for smaller companies, the NFC integration can cause difficulty in maintaining their turnover and increasing their profits. It’s because the cost of installing software & hardware with hiring technicians is very high.

A little security risk is still there

NFC payment technology is surely more secure when in comparison to credit card technology. Yet, it’s not completely free from risks. The rapid innovation and evolution in technology can have both positive and negative consequences.

Mobile phone hacking has become a common phenomenon, and hackers are coming up with new ways to trick customers by gaining access to their financial data. This risk makes the system a little prone to fraud and scams, which discourages customers and merchants from using NFC for payments.

However, customers and merchants can take a sigh of relief as security measures like encryption and tokenization make these payments safe from online fraud.

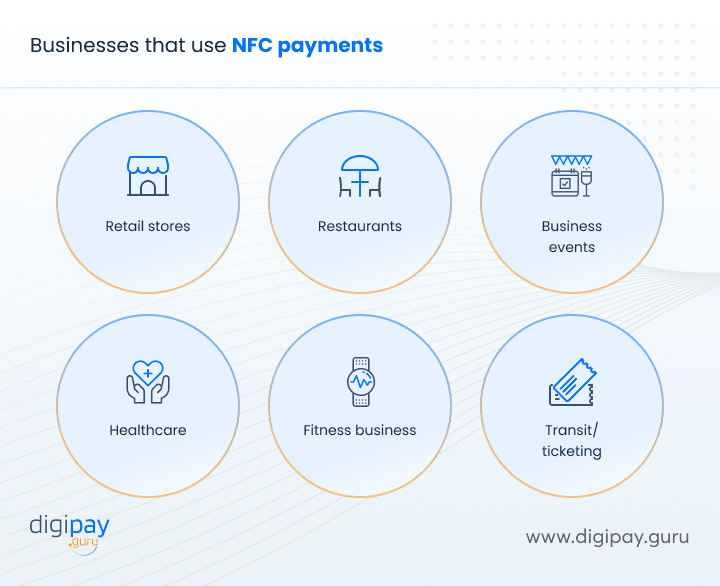

Businesses that use NFC payments: Use cases

NFC payments have made it easy for businesses to receive instant payments. Customers also prefer NFC payments because of the convenience it provides. So, it's a preferred payment method for so many businesses. Some are mentioned below:

Retail stores

Many retail stores, including department stores, clothing stores, and mobile stores, are using NFC payment to allow customers to make purchases quickly and easily.

Customers can simply hold their NFC-enabled payment card or device near the NFC reader on the point-of-sale (POS) system to complete the payment.

Restaurants

Many restaurants are using NFC for payments to streamline the payment process and reduce the risk of handling cash. Customers can use their NFC-enabled payment card or device to pay their bill at the table. This has eliminated the need to wait for a check or a card reader.

Business events

NFC payments can be a convenient option for businesses that host events, such as concerts, festivals, and sporting events. Customers can use their card NFC method or device to purchase tickets or pay for food and other items at the event.

Healthcare services

Doctors and other health professionals like dentists, psychologists, and many more are using NFC payment options to facilitate payments for the patient’s family members or the patient himself.

This allows the professionals to fully focus on the treatment process only and not the payment part of it as it is fully automated with NFC.

Fitness business

Businesses like gyms, yoga studios, and physiotherapy centres use NFC payment to receive payments from a large number of individual customers.

When integrated with fitness software, NFC contactless payment on phone offers a convenient and secure way for clients to settle their bills. This can make the overall experience smoother and more efficient.

Transit/ticketing

Transit systems like train stations, airports, and bus services have fully embraced NFC payments. Tap-and-go ticketing is ideal for advanced programs that integrate passenger entry, transfers, and more.

Contactless technology enables high-volume passenger throughput and frictionless travel across stations, lines, and turnstiles without bottlenecks. NFC to pay allows transport agencies to maximize convenience while maintaining security.

Conclusion

NFC payments are fast and convenient. And the process of making payments via NFC and accepting them is very simple. Plus, it supports multiple devices and can be implemented for numerous businesses.

Your customers will love this payment system due to its myriad benefits including advanced security, convenience, speed, versatility, and omnichannel payment.

NFC payments are the ultimate digital payment method that can make your business 50% more preferable than your competitors and will attract more customers and revenue.

Want to accept NFC payments?

DigiPay.Guru provides advanced and foolproof contactless payment solutions that can add quickness and convenience to your business. DigiPay.Guru's NFC payments supporting solutions like prepaid card management, digital wallet, mobile wallet, and merchant acquiring, can take your business to the next level of success and profitability.

If you are a business looking to accept NFC payments from your customers through an advanced NFC payment solution, you are at the right place. Connect with our experts today to discuss your requirements and integrate our NFC payment solution into your business.

FAQ's

NFC (Near Field Communication) is a wireless technology that lets two devices communicate when they're close together—usually within a few centimeters. It's the technology behind contactless payments that allows customers to pay with a simple tap using smartphones, smartwatches, or NFC-enabled cards.

For your remittance services, understanding this system helps you choose the best provider to offer competitive rates.

To accept NFC payments, you need an NFC-enabled POS terminal. Partner with a reliable payment solution provider like DigiPay.Guru to integrate NFC and contactless payment systems into your business. Educate your staff and customers to ensure smooth adoption.

Yes, NFC payments are highly secure. They use encryption, tokenization, and short-range technology, which makes it hard for hackers to intercept data. Many NFC payment apps also require biometric authentication or passcodes for added protection.

Popular examples of NFC mobile payments include:

- Apple Pay for iPhone and Apple Watch users.

- Google Pay for Android devices.

- Samsung Pay, which works on Samsung phones and smartwatches.

Other apps like PayPal and Venmo also support NFC mobile pay features.

Customers can pay using NFC by following these steps:

- Enable NFC on their device (e.g., in Android settings).

- Link their card to an NFC payment app like Google Pay or Apple Pay.

- Tap their device or card on an NFC-enabled terminal.

It’s that quick and easy!

Businesses can accept NFC payments by:

- Installing NFC-Compatible POS Terminals: Upgrade to a terminal that supports tap-and-pay technology.

- Integrating Payment Solutions: Work with a provider like DigiPay.Guru for smooth implementation.

- Educating Staff: Train employees to assist customers with NFC mobile payments.

This ensures a seamless and secure payment experience for both you and your customers.