With the rapid rise of technology, the way we make transactions has transformed dramatically. The digital payment landscape refers to the vast array of digital payment methods and platforms that exist today. From contactless payment solutions to mobile apps and online shopping, the digital payment landscape offers endless possibilities for consumers and businesses alike.

Despite the many benefits of digital payments, there are also real security concerns that must be addressed. From data breaches and phishing scams to fraudulent activities and malware attacks, these security issues of digital payment pose a significant risk to individuals and businesses alike.

As we increasingly rely on digital payments to handle our financial transactions, we must take steps to ensure that these transactions are secure. Without proper security measures in place, individuals and businesses face the risk of financial loss, the theft of sensitive information, and damage to reputation and trust.

In this article, we will delve into the various security threats that exist within the digital payment landscape and provide solutions and best practices for securing digital payments.

Why is Digital Payment Security Important in Today’s time?

According to a study by Cision PR Newswire, 69% of digital payment users are concerned with security issues. This stat suggests that security is a priority in digital payments.

Digital payment security is more important today than ever before due to the increasing amount of financial transactions that occur online. As more people adopt digital payment methods, such as online banking, mobile payments, and e-commerce transactions, the potential for fraud and identity theft also increases.

Here are some reasons why digital payment security is more important today:

Increased frequency of online transactions

With the rise of e-commerce and mobile payments, more transactions are being conducted online than ever before. This means that more sensitive financial information is being exchanged over the internet, making it a prime target for hackers and cybercriminals.

Sophisticated hacking techniques

Cybercriminals are becoming more sophisticated in their hacking techniques and can bypass many traditional security measures. This means that digital payment systems must be constantly updated and improved to stay ahead of the latest threats.

Greater potential for fraud

Digital payment systems are vulnerable to a range of fraud schemes, such as phishing, identity theft, and account takeover. These fraud schemes can result in significant financial losses for both consumers and businesses.

Increasing regulations

Governments and regulatory bodies are increasingly focused on digital payment security, with many countries introducing new laws and regulations to protect consumers and businesses. Failure to comply with these regulations can result in significant fines and reputational damage.

Types of Security Threats in Digital Payments

Fraudulent Activities

Fraudulent activities are a persistent threat in the digital payment landscape. This can take many forms, such as card skimming, fake online shopping sites, and phishing scams. These fraudulent activities are designed to steal sensitive information, such as credit card numbers and login credentials, and use it for financial gain.

Data Breaches

Data breaches are another major concern in the digital payment world. This can happen when unauthorized individuals gain access to sensitive information stored in a digital payment system. The information stolen in a data breach can be used for fraudulent activities or sold on the dark web.

Malware Attacks

Malware attacks are another serious threat in the digital payment landscape. Malware, short for malicious software, can infect a device and steal sensitive information, such as login credentials and credit card numbers. Malware attacks can also be used to spread false information or take control of a device.

Phishing Scams

Phishing scams are a form of fraudulent activity that use email or other forms of communication to trick individuals into revealing sensitive information, such as login credentials and credit card numbers. These scams often take the form of an email or message that appears to come from a trusted source, such as a bank or payment provider, and requests sensitive information.

These security threats are a reality in the digital payment landscape and individuals and businesses must be aware of the dangers and take steps to protect themselves. In the following section, we will examine the impact of these security threats and what can be done to mitigate the common digital payment risks.

Impact of Security Threats on the Digital Payment Landscape: The Cost of Insecurity

Loss of Sensitive Information

One of the most damaging effects of digital payment security threats is the loss of sensitive information. This can include financial information, such as credit card numbers and bank accounts, as well as personal information, such as social security numbers and login credentials.

The theft of sensitive information can have far-reaching and long-lasting effects, making it essential to protect this information at all costs.

Financial Loss to Individuals and Businesses

Security threats in mobile finance solutions can also result in financial loss to individuals and businesses. Fraudulent activities, such as card skimming and phishing scams, can steal financial information and use it to make unauthorized transactions. Data breaches can also result in financial loss, as sensitive information can be sold on the dark web.

Read More: Security threats in mobile finance solutions

Damage to Reputation and Trust

The impact of the threat of security in the digital payments landscape goes beyond financial loss. When security breaches occur, individuals and businesses can lose the trust of their customers. This can damage brand reputation and make it more difficult to regain that trust.

This is why it's so important for businesses to take steps to secure their digital payments and protect the sensitive information of their customers.

Read More: Securing your online payments system for your customers

To mitigate the risks posed by security threats in the digital payment landscape, it's essential to implement effective security solutions and follow best practices for secure digital payments. In the following sections, we will explore the security solutions and best practices available for securing digital payments and protecting sensitive information.

Security Solutions in the Digital Payment Landscape: A Path to Confidence and Peace of Mind

The digital payment landscape has significantly expanded in recent years, providing consumers with convenient and easy ways to make purchases and transfer money. However, with the increased use of digital payment methods, comes a heightened risk of security breaches and fraud.

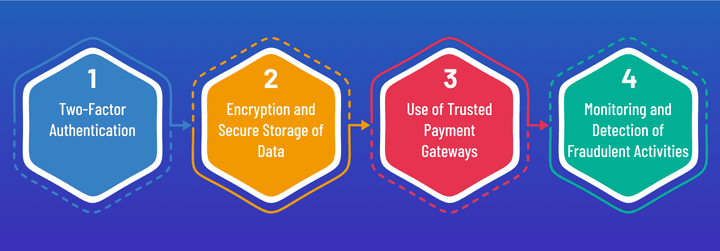

In order to ensure confidence and peace of mind in the digital payment landscape, there are several security solutions that can be implemented. These include:

Two-Factor Authentication

Two-factor authentication (2FA) is a security solution that requires two forms of identification before granting access to sensitive information. This can include a password and a unique code generated by an app or sent via text message, providing an extra layer of security to protect sensitive information.

With 2FA in place, even if a password is stolen, it is much more difficult for fraudsters to access sensitive information.

Encryption and Secure Storage of Data

Encryption is the process of converting sensitive information into a code that can only be decrypted with the proper key. This makes it much

Use of Trusted Payment Gateways

Trusted payment gateways are secure platforms that process digital payments and protect sensitive information. These gateways use advanced encryption and security measures to ensure that sensitive information is protected from theft or fraud.

By using a trusted payment gateway, individuals and businesses can ensure that their digital payments are secure and that sensitive information is protected.

Monitoring and Detection of Fraudulent Activities

Monitoring and detecting fraudulent activities is another critical component of securing digital payments. This can include the use of advanced algorithms and artificial intelligence to detect suspicious transactions and identify potential fraud.

By monitoring and detecting fraudulent activities, fintech and related businesses can take steps to prevent financial loss and protect sensitive information, which in turn enhances user satisfaction.

How are fintechs combating fraud and enhancing user satisfaction?

Best Practices for Secure Digital Payments: Protecting Yourself and Your Business

Regular Software Updates

Regular software updates are a critical component of securing digital payments. These updates can include security patches that address vulnerabilities and keep sensitive information protected. By keeping software up to date, individuals and businesses can ensure that they are protected against the latest security threats in the digital payment landscape.

Use Strong and Unique Passwords

Strong and unique passwords are essential for protecting sensitive information in the digital payment landscape. This includes using passwords that are at least 12 characters long and contain a mix of letters, numbers, and symbols.

It is also important to use a different password for each online account, as this makes it more difficult for fraudsters to access sensitive information if one password is stolen.

Awareness of Phishing Scams and Other Fraudulent Activities

Awareness of phishing scams and other fraudulent activities is essential for protecting against security threats in the digital payment landscape. Phishing scams are emails or messages that appear to be from a trusted source but are actually from fraudsters attempting to steal sensitive information.

By being aware of these scams and taking steps to protect against them, individuals and businesses can prevent the loss of sensitive information and protect against financial loss.

Verification of Payment Recipients

Verifying payment recipients is another important best practice for securing digital payments. This can include confirming the identity of the recipient, checking the authenticity of their website, and using secure payment methods.

By verifying payment recipients, individuals and businesses can protect against fraudulent transactions and ensure that their digital payments are secure.

Final Words

The security of digital payments is a critical concern for individuals and businesses alike. With the rise of digital transactions and the increasing threat of cybercrime, it is essential to have robust security solutions in place. However, with so many options available, it can be difficult to know where to turn for reliable protection.

This is where DigiPay.Guru comes in. Our team of experts has extensive experience in the digital payment landscape and offers a full range of highly secure digital payment solution.

Our solutions include an advanced mobile money solution providing two-factor authentication, encryption and secure storage of data, trusted payment gateways, and monitoring and detection of fraudulent activities. Additionally, we offer best practices for secure digital payments, including regular software updates, strong and unique passwords, awareness of phishing scams and other fraudulent activities, and verification of payment recipients.

At DigiPay.Guru, we are committed to providing top-notch payment security and protection for our clients. Our team of experts is available to answer your questions and help you navigate the digital payment landscape with confidence.

So why wait? Choose DigiPay.Guru and experience the peace of mind that comes with secure, reliable digital payments.