Digital adoption in financial services continues to rise across the world. Customers now move money, pay bills, borrow credit, and manage their savings through digital channels more than ever.

Plus, a recent McKinsey report shows that more than 70% of consumers prefer digital-first financial services! And this shift has pushed banks and financial businesses like yours to rethink how they operate.

With this growth comes new challenges:

- Fraud patterns evolve faster.

- Compliance requirements become stricter.

- Operational costs increase as transaction volumes grow.

Your customers also expect quicker responses, smoother experiences, and personalized financial guidance. And meeting these expectations with traditional systems alone becomes difficult.

This is where AI in fintech and machine learning in fintech play a meaningful role. They help businesses like yours strengthen security, improve decision-making, automate manual work, and build more relevant customer experiences.

In this blog, you will explore

- What AI and ML mean for the modern financial ecosystem

- Why are they becoming essential

- How different sectors use them

- Key use cases of artificial intelligence and ML, benefits, & challenges

- Future trends, and how DigiPay.Guru helps you adopt AI confidently and effectively

Let’s begin with the basics.

What Is AI & Machine Learning in Fintech?

Artificial intelligence helps you solve problems with machine-driven decisions. Machine learning helps those decisions improve over time.

Let’s understand these layers with a quick overview first:

| Technology | What It Means | Example in FinTech |

|---|---|---|

| Artificial Intelligence | Machines performing cognitive tasks | Chatbots, fraud detection |

| Machine Learning | Algorithms learning from data | Credit scoring, risk models |

| Deep Learning | Neural networks for complex tasks | AML anomaly detection |

Now, let’s understand each of them (AI, ML, and Deep Learning) in brief:

What Does AI Mean in Fintech?

Artificial intelligence (AI) mirrors certain human abilities. It thinks, decides, and predicts outcomes using structured and unstructured data.

In fintech, AI helps you automate repetitive tasks:

- It supports decisions across fraud risk, customer experience, and compliance.

- It can analyze thousands of data points faster than any team member.

This makes it a perfect fit for digital payments, remittances, risk management, and financial services that rely on speed and accuracy.

What Is Machine Learning (ML)?

Machine learning takes your financial data and finds patterns that traditional systems miss.

It:

- Predicts credit risk.

- Monitors account activity.

- And helps you understand user behavior.

This makes machine learning in fintech ideal for underwriting, risk scoring, payment routing, and fraud detection.

P.S.: ML becomes more accurate as it processes more data. That means your fintech operations keep improving with time.

Deep Learning

Deep learning uses neural networks to solve complex tasks. These tasks include AML checks, biometric verification, voice-based authentication, and suspicious activity monitoring.

If your fintech ecosystem deals with large data streams or high-value transactions, deep learning improves security and reliability across every layer.

Why Should You Use AI & ML in Fintech?

Artificial intelligence (AI) and machine learning (ML) have become essential tools in the fintech landscape.

These technologies can enhance decision-making processes, improve customer experiences, and increase operational efficiency.

In particular, there are 5 direct reasons why leaders across the fintech industry invest in these technologies. They are:

Enhanced Customer Experience

Your customers want personalized financial services. AI helps you offer exactly that.

You can:

- Tailor offers, payment flows, reminders, and product recommendations

- Deploy AI chatbots that respond instantly while reducing waiting time

- Solve more cases without adding more staff, and

- Offer a smooth and friendly banking or payment experience

Improved Operational Efficiency

AI and ML allow you to automate tasks that consume time and manpower.

You can:

- Automate document checks

- Streamline onboarding

- Score customer applications within seconds

- Detect patterns in business operations that help you improve processes

These gains lower your cost and boost team productivity.

Fraud Detection & Prevention

Fraudsters do not take days off. They keep finding ways to breach the security of your payment system.

AI gives you an edge here by:

- Monitoring patterns in real time

- Detecting anomalies before damage occurs

- Analyzing user behavior

- Identifying bots, account takeovers, false identities, and suspicious transfers.

This makes artificial intelligence in fintech one of the most powerful tools for fraud prevention.

Better Investment & Financial Decision Management

AI helps your customers invest smarter.

With AI, you can:

- Power robo-advisors that create balanced portfolios

- Analyze market conditions & forecast risks

- Support better financial decisions and increase customer trust

This use case continues to grow across AI in the fintech market.

Compliance & Risk Management

You deal with strict regulations when it comes to digital payments. And AI helps you comply with them.

- It automates AML screening

- It verifies identities with high accuracy

- It flags high-risk patterns

- It reduces false positives

- It protects you from penalties & compliance failures

- And helps you scale without fear.

AI Market Overview in Fintech

AI is becoming one of the strongest drivers of digital transformation in financial services. You see this shift not only in large banks but also in digital wallets, payment companies, remittance providers, lenders, and wealth platforms.

This growth is not theoretical, but is supported by clear and measurable trends across the global AI in fintech market.

Here are the most relevant insights shaping the industry today:

- The global AI in Fintech industry is projected to reach $83.1 billion by 2030.

- Another major forecast shows the market rising to $41.16 billion by 2030, while registering a 16.5% CAGR.

- 78% of organizations worldwide now use AI in at least one business function, a jump from 72% last year.

- Cloud-based AI deployments hold nearly 82% market share, with hybrid models also expanding rapidly.

- Fraud and risk management account for roughly 31% of total AI spending in fintech, which shows the priority financial institutions place on security.

- Chatbots and virtual assistants are the fastest-growing AI use cases, with a projected growth rate above 36% CAGR.

- Financial institutions invested $35 billion in AI technologies in 2023, which covers banking, payments, credit, compliance, and operations.

These numbers show a clear direction.

AI is no longer an experimental add-on. It is becoming foundational infrastructure across banking and finance.

AI is replacing manual checks, accelerating decisions, and strengthening security at scale.

As digital transactions increase each year, AI will continue to serve as the backbone of efficient, compliant, and customer-centric fintech ecosystems.

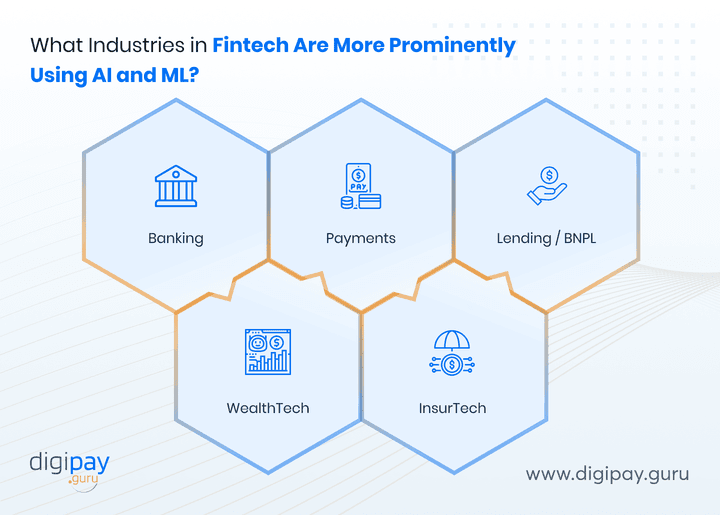

What Industries in Fintech Are More Prominently Using AI and ML?

Different sectors use AI for different purposes. The table below gives you a quick look at the most common uses.

| FinTech Sector | AI Use Case |

|---|---|

| Banking | KYC automation, personalized offers |

| Payments | Fraud detection, chargeback reduction |

| WealthTech | Robo-advisory, portfolio optimization |

| Lending | AI scoring, borrower prediction |

| InsurTech | Claims automation, risk pricing |

State of AI and ML: A Sector-Wise Insights

Let’s see how AI and machine learning in fintech transform the financial landscape for varied sectors:

Banking: AI in banking and finance is used to verify identities faster. They detect fraud early, offer personalized financial insights, and use machine learning for credit risk analysis.

Payments: Payment companies rely on AI to manage fraud. They optimize routing, cut chargebacks, and reduce transaction failures.

Lending / BNPL: AI helps lenders understand borrower behavior. It supports alternative-data credit scoring and reduces risk for underserved or thin-file customers.

WealthTech: AI powers investment platforms. It helps users create personalized strategies and improves financial health.

InsurTech: Insurance firms automate claims. They price premiums more accurately and detect false claims early.

Most Prominent Use Cases of AI & ML in Fintech

The benefits of AI and ML in digital fintech solutions have been significantly appreciated across the financial and payment industry.

So you might think, yes, there are these benefits, but does it really work practically? The answer is yes!

But, where is the evidence?

Don’t worry, in the section below, we will discuss some prominent use cases in the AI based fintech and ML fintech industry.

Fraud Detection & Risk Monitoring

AI algorithms can analyze transaction patterns and identify potential fraudulent activity, while helping you prevent financial losses and protect customers' assets.

Here’s how it does that:

- Compare user actions with expected patterns

- Trigger alerts for suspicious transfers

- Reduce false positives while increasing accuracy

Read More: How FinTech is Enhancing User Satisfaction & Combating Fraud

eKYC, AML & Identity Verification Automation

With AI and ML, you can automate identity verification, use OCR to scan documents, and use facial recognition to match identities. You can also use deep learning to detect spoofing attempts. Plus, you can reduce onboarding time by more than half.

Credit Scoring & AI-Based Lending

AI looks beyond credit history. It evaluates spending habits, checks income stability, and analyzes digital footprints.

These models create fairer and more inclusive credit decisions, which helps lenders operate with lower risk and greater speed.

Customer Experience & Hyper-Personalization

AI groups your customers based on behavior. It predicts their needs and offers personalized product suggestions.

This enhances loyalty and retention. Plus enables you to provide meaningful experiences without extra human effort.

Back-Office & Operational Automation

Your back-office teams manage heavy workloads. But AI reduces that pressure.

It automates reconciliation, processes tickets, and completes document checks. This helps you save time, save money, and reduce error rates.

Payment Optimization & Smart Routing

Payment optimization is where AI shines for payment companies like yours.

AI can:

- Measure payment success rates

- Select the best route in real time

- Reduce declines and cut the cost per transaction

- Plus, it improves reliability for merchants and customers

Wealth & Investment Automation

Robo-advisors use AI to create investment portfolios based on risk appetite.

They rebalance funds, track performance, and guide your customers with better insights. This builds trust and long-term relationships.

Predictive Analytics & Financial Forecasting

AI predicts cash flow for your business. It forecasts transaction volumes, alerts you to potential risks, and helps you plan operations with more confidence. This becomes a competitive advantage for any scaling fintech.

Benefits of AI in Fintech

Here are the most important benefits of artificial intelligence brings to financial services today:

- Stronger fraud prevention by detecting anomalies in real time instead of reacting after losses occur.

- Faster onboarding through automated eKYC, document extraction, and instant identity verification.

- Lower operational costs as AI takes over manual, repetitive tasks across support, verification, and risk workflows.

- Higher decision accuracy, especially in credit scoring, risk assessment, compliance checks, and payment routing.

- Real-time insights that help you understand transactions, customer behavior, risk patterns, and business performance.

- Better personalization, while allowing you to tailor product offers, payment experiences, and communication for every customer segment.

- Reduced false positives in fraud and AML checks, thereby improving both compliance accuracy and user experience.

- Faster issue resolution using AI chatbots and agent-assist tools that cut response times and improve customer satisfaction.

- Improved scalability, enabling you to handle higher volumes of transactions and customers without increasing headcount.

- Lower risk exposure, as AI continuously monitors activity and highlights threats before they impact your operations.

Challenges & Considerations in AI Adoption

Before you finalize the implementation of AI in your financial system, there are some challenges and considerations you should keep in mind:

Challenges

AI delivers strong value, but you will face a few practical hurdles that can slow down or complicate adoption across your financial ecosystem.

- Data quality issues limit the accuracy of AI models, especially when financial data is incomplete, inconsistent, or siloed.

- Legacy system limitations make it difficult to integrate modern AI workflows with older banking and payment infrastructures.

- Model bias risks can lead to unfair credit decisions or inaccurate fraud assessments if training data is skewed.

- High initial investment in AI development, training, and infrastructure can be a barrier for many institutions.

- Skill gaps across teams slow down AI adoption because many organizations lack experienced data and ML specialists.

Considerations

Before you implement AI at scale, you will also need to evaluate a few strategic factors to ensure long-term success and responsible deployment.

- Define clear AI objectives to ensure every model supports measurable business or compliance outcomes.

- Choose the right deployment model (cloud, hybrid, or on-prem) based on your regulatory and operational requirements.

- Build strong governance frameworks to monitor AI models, track performance, and manage ethical risks.

- Establish data privacy controls that comply with local and international regulations, especially for cross-border financial data.

- Plan continuous model retraining to keep accuracy high as fraud patterns, user behavior, and market dynamics evolve.

Traditional FinTech vs AI-Driven FinTech

Here is a quick comparison of both approaches (traditional and AI-driven) fintech:

| Factor | Traditional FinTech | AI-Driven FinTech |

|---|---|---|

| Fraud Detection | Reactive | Predictive |

| Customer Support | Human-only | Automated + Human |

| Decision Making | Manual | Real-time AI |

| Cost | High | Reduced |

| Personalization | Limited | Advanced & Dynamic |

Leveraging AI in Fintech: Real-World Examples

AI is already transforming financial services today, and you can see its impact clearly through real-world AI use cases in financial services across various sectors like banks, fintechs, and payment companies:

- Banks use AI for AML and fraud detection, which allows compliance teams to flag high-risk activities faster and with higher accuracy.

- Fintech lenders rely on ML-based scoring models to evaluate borrowers using alternative data and reduce default risks.

- Payment processors adopt AI-driven smart routing, thereby improving transaction success rates and lowering processing costs.

- Digital wallet providers use AI-powered onboarding to identify users instantly, reduce drop-offs, and prevent identity fraud.

The Future of AI in Fintech

AI is moving from supportive technology to core financial infrastructure, and the next wave of innovation will reshape how institutions operate, secure, and scale their services:

- Generative Artificial Intelligence in banking will automate communication, summarize documents, and support complex customer queries instantly.

- Autonomous finance will help customers make smarter decisions by using AI-driven insights to manage savings, payments, and investments automatically.

- Predictive compliance will reduce regulatory risk while identifying suspicious behavior and compliance gaps before they become issues.

- AI-led cross-border payment optimization will improve success rates while selecting the best payment corridors based on real-time performance.

- AI-powered agents and mobile money networks will operate more intelligently by using predictive models to manage liquidity, user behavior, and transaction patterns.

Conclusion

AI has become one of the most important enablers in modern financial services. As transaction volumes rise and customer expectations evolve, the limitations of traditional systems become clearer.

AI helps you reduce fraud, improve compliance accuracy, automate manual work, and deliver better experiences without adding unnecessary operational load.

For financial businesses like yours, the value is straightforward. AI strengthens your decision-making, gives you real-time visibility, and supports faster onboarding, smarter risk scoring, & more reliable payment journeys.

These benefits help you build trust, scale services, and operate with more confidence in fast-changing markets.

And if you are exploring how AI fits into your digital payment or fintech roadmap, DigiPay.Guru can support you with the right foundation.

Our platform brings together AI-powered onboarding, fraud prevention, smart routing, and predictive analytics while helping you launch secure, scalable, future-ready financial products with ease.

So, don't hold back; our team is here to guide you whenever you're ready to move forward.

FAQs

AI in Fintech refers to technologies that help financial institutions like yours automate decisions, analyze data more effectively, and enhance customer experiences. It includes tools such as predictive analytics, chatbots, smart routing, fraud detection engines, and AI-driven onboarding systems. AI enables faster, more accurate, and more secure financial operations.

Machine learning is used to identify patterns in transaction data, evaluate risk, score credit, detect fraud, personalize services, and automate compliance workflows. ML models improve over time as they process more data, which makes them ideal for lending, payments, onboarding, underwriting, and behavioral analytics.

The most common use cases include fraud detection, eKYC and identity verification, payment optimization, credit scoring, AML monitoring, customer support automation, portfolio management, and predictive analytics. These use cases help financial institutions like yours reduce losses, cut processing time, and improve customer experience.

Yes, AI is safe when implemented with proper governance. You must use compliant data practices, ensure transparency in decision-making, and monitor models regularly. With the right controls, AI strengthens security, reduces human errors, and supports more accurate and consistent financial decisions.

AI analyzes transaction patterns in real time and flags anomalies faster than traditional rule-based systems. It evaluates user behavior, device data, transaction history, and risk signals simultaneously. This allows you to detect suspicious activity earlier, reduce false positives, and react before financial loss occurs.

Yes. AI helps personalize products, automate support, recommend financial actions, streamline onboarding, and predict user needs. AI chatbots, personalized dashboards, and automated insights create smoother and more relevant experiences for customers across digital banking, payments, wallets, and lending platforms.

Common challenges include data quality issues, integration with legacy systems, model bias, regulatory compliance, and the need for ongoing model monitoring. Many institutions also face skill gaps in data science and machine learning. Addressing these challenges early ensures a smooth and responsible adoption of AI.