If you work in a bank or financial institution, you already know onboarding is no longer a simple front-desk task. Every new customer now represents a compliance decision, a fraud risk, and a future audit trail that regulators may examine in detail.

Across African markets, the pressure is familiar. Physical KYC slows account opening and frustrates customers. Branch-based verification struggles to scale.

Fraud attempts are becoming more deliberate. At the same time, regulators expect clear proof of how identities were verified, not just a stack of collected documents.

This is where many traditional onboarding processes begin to break down.

Video KYC solution has emerged as a practical response to these realities. Not as a convenience feature, but as a controlled, real-time way to online video KYC while maintaining visibility, accountability, and regulatory confidence.

It allows institutions to move faster without losing control of the verification process.

This article explains how Video KYC works for banks and financial institutions, why it is being adopted across regulated markets, and how it supports faster onboarding without compromising compliance.

It is written for institutions that need onboarding processes that hold up not only at launch, but also during audits, investigations, and growth.

What Is Video KYC for Banks and Financial Institutions?

Video KYC is a digital identity verification process where a customer’s identity is verified through a live video interaction with an authorized officer or agent. During the session, identity documents are validated, the customer’s presence is confirmed, and biometric or liveness checks are performed in real time.

Unlike traditional KYC, which relies on physical presence and manual document handling, Video KYC enables remote onboarding while preserving human oversight. The KYC video verification process is recorded, time-stamped, and securely stored, creating a verifiable audit trail.

For banks, non banking financial companies, and licensed financial institutions, Video identity verification is not just about speed. It provides a structured way to demonstrate that customer verification was conducted responsibly, by a trained verifier, under controlled conditions.

Video KYC is commonly used for:

-

Retail and commercial bank account opening

-

NBFC loan and credit verification

-

Digital wallet and payment app onboarding

-

Cross-border or remote customer verification

Why Banks and Financial Institutions Are Adopting Video KYC?

The shift toward Video KYC is driven by operational and regulatory realities, not trends.

Traditional KYC processes introduce delays, increase manual workload, and create gaps in video verification evidence. As customer volumes grow, these gaps become harder to manage and easier for fraud to exploit.

Regulators increasingly expect institutions to show:

-

how identity verification was performed

-

who conducted the verification

-

what evidence was reviewed

-

and whether the process can be audited later

Video KYC addresses these expectations by combining live interaction with recorded proof. It reduces dependency on physical branches, accelerates onboarding timelines, and strengthens fraud controls through liveness detection and human validation.

For institutions operating across multiple regions or serving remote populations, Video KYC also enables consistent onboarding standards without sacrificing regulatory discipline.

How Do You Distinguish Video KYC from a Conventional One?

Traditional KYC relies heavily on in-person visits and document collection. While familiar, it is slow, difficult to scale, and increasingly misaligned with digital banking models.

Live video call verification introduces a controlled remote alternative. Verification happens in minutes instead of days. Customer presence is confirmed live. Identity checks are recorded and retrievable. Most importantly, institutions retain evidence that stands up during audits.

For regulated financial institutions, this shift is less about digitization and more about defensibility. Video KYC allows teams to onboard customers faster while strengthening their compliance posture.

Difference between traditional KYC and Video KYC

Whether you're a bank or a financial institution, video KYC is an important step in ensuring that your customers are safe and compliant. Here’s how banks and financial institutes can count on Video KYC.

| Feature | Traditional KYC | Video KYC |

|---|---|---|

| Verification Time | Days | Minutes |

| Customer Presence | Physical | Remote |

| Fraud Risk | High | Low (biometric + live) |

| Compliance Readiness | Limited | High |

| Scalability | Low | High |

| Cost Efficiency | Expensive | Cost-effective |

Video KYC Use cases -

Here the division has been on the basis of institution type.

| Institution Type | Video KYC Use Case |

|---|---|

| Retail Banks | Customer onboarding |

| Corporate Banks | Business verification |

| NBFCs | Loan & credit verification |

| Top Merchant Banks | Investor verification |

| European Investment Bank | Cross-border onboarding |

| Digital Banking Institutions | Fully remote KYC |

How Video Identity Verification Works – Step-by-Step

KYC (Know Your Customer) is a processing bank and other financial institutions used to verify customer identities. With video verification, they're able to do this more efficiently. Video KYC is also more secure than traditional methods, which is why it's becoming increasingly popular among institutions.

The benefits of eKYC solutions for banks and financial institutions are clear - it's faster, easier, and more secure! Furthermore, by using video technology, banks and other financial institutions can verify customer identities through biometric parameters, including facial recognition, Retina. And here’s how you can integrate it into your operations.

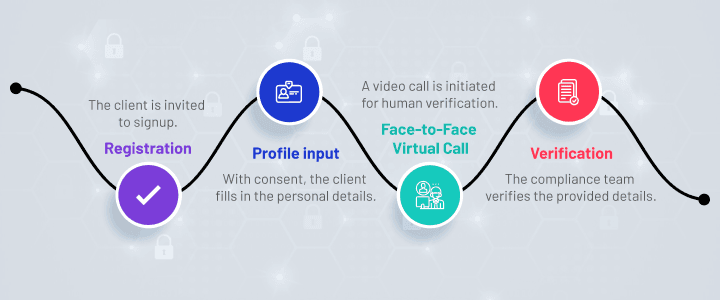

Step 1: Registration

Banks are now requiring all customers who want access to bank accounts, loans, insurance policies, to register for various purposes such as ID verification, document verification, loan applications.

Video KYC account opening is thus becoming an essential part of maintaining trust and security for initiating the customer onboarding process. Video KYC also helps improve customer experience by reducing the time it takes to complete a transaction or open an account.

Step 2: Profile input

From increased security to faster transactions, banks need to gather profile information by collecting important details like customer name, security number, contact number, and address.

Video KYC has emerged as one of the most efficient and secure ways of conducting KYC, owing to its many advantages such as speed, convenience, accuracy, scalability, and usability in advanced mobile money solutions.

Step 3: Face-to-Face Virtual Call

Video KYC allows for identification through video footage instead of just a photo ID. This technology has revolutionized the way bank officials can verify customer identities. It has become so reliable that many banks are now using it as the primary method of identity verification.

This means that not only is video KYC less time-consuming and costly, but it also reduces the chances of fraudulence or misuse of personal data by customers.

Step 4: Verification

Bank executives can virtually verify the customer by examining the physical document on call. The customer needs to present all important physical documents like address proof for address verification, ID proof, and security number to finalize the whole verification process.

A video KYC process helps protect customer data and boost security. Plus, by verifying identity online, customers can increase the conversion rate by opening up new doors for them to explore your offering further. Ensuring that all necessary procedures have been followed is crucial in maintaining trust with current and potential customers.

Security Features of Video KYC for Banking Institutions

For banks and top financial institutions, security is not optional. Video KYC platforms must meet strict operational and regulatory expectations.

Key security and compliance features include:

-

End-to-end encryption of video sessions and data

-

Liveness detection to prevent spoofing and replay attacks

-

Secure storage of recorded sessions and documents

-

Tamper-proof logs and time-stamped audit trails

-

Role-based access for compliance and investigation teams

These controls help institutions reduce fraud risk while maintaining clear accountability throughout the onboarding process.

Benefits of Video KYC for Banks and Financial Institutes

There are several reasons why video KYC is becoming increasingly popular for digital wallet software solutions. Some of the benefits for both the customer and institution include:-

-

Bottom Line Effect: KYC is a cost-intensive process and is mandatory. There is no mistake, so if it can be done with digital assets (paperless and video-based), without the logistics cost of going to the location of KYC officials, nothing. As per recent reports, banks can save up to 50 percent by implementing a digital onboarding process, including video KYC.

-

Fast Turnaround Time: Finance is a competitive sector. For any reason, if a company cannot complete KYC, it leads to potential business loss. The KYC verification process, which usually takes around 10-20 days, can now be completed in 10 minutes, all with a high degree of automation and digitization.

-

Seamless customer onboarding: Thanks to video KYC checks, many new-age fintech companies are growing rapidly, offering excellent customer onboarding, Know Your Customer (KYC), and eventually, a range of financial products. This is in favour of a customer as now they can access better financial product services with the convenience of staying indoors. It also means inheritance businesses ought to quickly adjust and digitize their operations or risk missing out on the next era of business.

-

Secured transaction: Controllers require KYC verification, especially to control forgery, money laundering, and financial crimes. Once concluded, the videotape can be accumulated for KYC record keeping and access.

-

Reduced operating costs: Today, video KYC is a big step forward in making this process more efficient and secure. With video KYC, banks can verify customer identities in a safe and video-based environment. This technology can potentially reduce the costs of processing and verifying customer identities by 90%. Additionally, video KYC is simple to use, so there is little training required for employees.

Now you have learned the pros of integrating Video KYC in your banking, but you should understand the important aspects before investing in Video KYC. This guide can help you determine the characteristics of the best product for your financial operations.

Benefits of Video KYC by Banking Function

| Banking Function | Business Benefit |

|---|---|

| Customer Onboarding | Faster verification |

| Compliance Teams | Better audit trails |

| Risk Management | Fraud reduction |

| Operations | Cost optimization |

| Digital Banking | Seamless UX |

How to Choose the Right Video KYC Solution for Banks and Financial Institutions

Choosing the right Video KYC solution is a long-term compliance and operational decision, not just a technology choice. Banks and financial institutions must ensure the solution is regulator-accepted, audit-ready, and capable of securely storing verifiable evidence for years. Live human oversight, strong security controls, seamless integration with existing systems, and the ability to scale across markets are critical.

Equally important are operational visibility and clear vendor accountability, including data ownership and support during regulatory reviews. Solutions that prioritize speed over control may work initially, but often create risk as scrutiny and volumes increase.

Where DigiPay Guru Fits in Video KYC for Regulated Institutions

DigiPay Guru provides Video KYC as part of its broader digital onboarding and payments infrastructure, designed specifically for regulated financial institutions.

The Video KYC solution is built to support banks, NBFCs, and fintechs that require:

-real-time identity verification

-strong auditability

-seamless integration with existing onboarding flows

DigiPay Guru’s Video KYC is white-label and API-driven, allowing institutions to embed live video verification into their own applications without disrupting branding or customer experience. Recorded sessions, verification logs, and compliance data are securely stored to support audits and regulatory reviews.

Because DigiPay Guru also supports digital wallets, mobile money, remittance, and merchant onboarding, Video KYC fits naturally into end-to-end customer lifecycle management. Institutions can use a single infrastructure layer for onboarding, transactions, and compliance, reducing fragmentation and operational risk.

For regulated institutions, this means faster onboarding without sacrificing control, visibility, or regulatory confidence.

FAQs

Video KYC is a digital identity verification process where a customer’s identity is verified through a live video interaction with an authorized officer. The session is recorded, time-stamped, and stored to support compliance and audits.

Yes. Video KYC is secure when it includes live verification, liveness detection, encrypted video sessions, and tamper-proof storage of records. These controls help banks prevent impersonation and maintain audit-ready evidence.

In many jurisdictions, video verification is legally accepted when conducted under regulator-approved guidelines. Acceptance depends on local regulations and requires proper documentation, recording, and compliance controls.

Yes. NBFCs and merchant banks commonly use Video KYC for customer onboarding, credit verification, and investor due diligence, provided the process aligns with regulatory and licensing requirements.

Real-time verification reduces fraud by confirming live customer presence, validating identity documents during the session, and preventing spoofing or replay attacks through liveness checks and human oversight.

Yes. Video KYC is suitable for international financial institutions when designed to support cross-border compliance, secure data handling, and country-specific regulatory requirements.

A typical Video KYC session takes only a few minutes to complete, depending on document checks and verification steps, significantly faster than traditional in-person KYC processes.