In today's fast-paced world, contactless payments have become increasingly popular due to their convenience and safety. With the COVID-19 risks still looming, more and more consumers are turning to contactless payment options to avoid physical contact. As a result, merchants are finding it important to accept digital payments to meet the evolving needs of their customers.

One type of contactless payment that has gained significant attention in recent years is the closed-loop wallet. This type of digital wallet solution is a payment system that allows users to store funds and make purchases with participating merchants.

According to a recent study by GlobeNewswire, the global digital payment market is projected to reach a staggering $19.89 trillion by 2026 at a CAGR of 24.4%. With such a significant increase in the adoption of digital payments, it is crucial for merchants to stay up-to-date with the latest payment trends to remain competitive in the market.

Moreover, according to a 2022 study by Barclays, it was discovered that the total value of all kinds of contactless payments increased by 49.7 % as of 2022. The study also says that the users made an average of 220 contactless payments each, which amounts to almost Euro 3327 per person.

The above figures depict how important contactless payments have become for merchants to provide to their customers if they want to ace their business and move toward profitability. And contactless payment options like closed-loop wallets have the potential to fulfill customers’ expectations in a personalized manner.

In this blog, we will explore the concept of closed-loop wallets, how are closed-loop wallets beneficial for merchants, how can merchants Implement closed-loop wallets, the future of contactless payments, best practices for merchants using closed-loop wallets, and futuristic contactless payments.

What are Closed Loop Wallets?

Closed loop wallets, also known as closed loop payment systems or closed loop payment networks, are payment systems that are designed for use within a specific group of merchants or businesses.

These systems allow users to make purchases using funds that have been pre-loaded onto a card or digital account, which can then be used to make purchases only within the designated network of merchants.

One example of a closed loop wallet solution is the Starbucks mobile app. With the Starbucks app, users can add funds to their digital wallets and then use those funds to make purchases at any Starbucks location. The app also allows users to earn rewards and receive special offers, which can be redeemed within the Starbucks network.

Another example of a closed loop wallet as a merchant payment solution is the Amazon Gift Card. Amazon Gift Cards allow users to load funds onto a digital account, which can then be used to make purchases on Amazon.com or other affiliated websites. These funds cannot be used outside of the Amazon network, which makes it a closed loop system.

Read More: Adopting and implementing closed-loop payment systems

How does it work?

Closed loop wallets typically work by pre-loading funds onto a digital account or card, which can then be used to make purchases only within a designated network of merchants. These networks can include businesses in a specific industry or chain of stores, such as Starbucks or Amazon.

Let’s have a look at how the entire process of payments with closed loop wallets works with some real-life examples:

| Step | Time Period | Example |

|---|---|---|

| 1 | User loads funds onto their digital account or card | Adding funds to a Starbucks mobile app or Amazon Gift Card |

| 2 | User makes a purchase within the designated network of merchants using the funds on their account or card | Paying for a drink at a Starbucks location or making a purchase on Amazon.com |

| 3 | Transaction is processed within the closed loop payment network, with no need for the user to provide sensitive financial information | Funds are deducted from the user's digital account or card balance |

| 4 | Merchant receives payment from the closed loop payment network | Starbucks or Amazon receives payment from the closed loop payment network |

| 5 | User may earn rewards, discounts, or other incentives for using the closed loop payment system | Earning free drinks or food items with the Starbucks Rewards program |

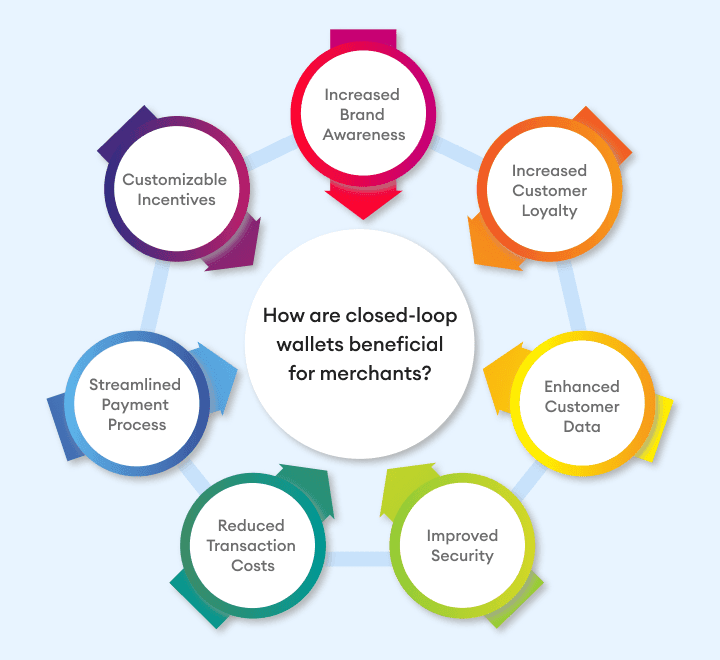

How are closed-loop wallets beneficial for merchants?

In the world of payment systems, closed-loop wallets are gaining popularity as a secure and efficient payment method. Closed-loop wallets, also known as closed-loop payment systems, are digital payment systems that enable customers to store money in an account associated with a particular merchant or service provider.

This system allows customers to make transactions directly with the merchant, without the involvement of banks or third-party payment processors. Closed-loop wallets are becoming increasingly popular due to their numerous benefits for both customers and merchants.

In this section, we will focus on the advantages that closed-loop wallets provide to merchants.

Increased Customer Loyalty

The users of closed loop wallets return to the same network of merchants to make future purchases. They are also encouraged by offering rewards and discounts exclusively within the wallet.

Dunkin' Donuts Perks program rewards customers with points for using their closed-loop wallet app to make purchases which can be redeemed for free drinks and other rewards, encouraging continued app use and purchases.

Enhanced Customer Data

Closed loop wallets provide merchants with valuable data on their customers' purchasing behavior. Merchants can use wallet data to gain insights into customer preferences, purchase history, and other valuable information for marketing and sales strategies.

For Example, the Walmart Pay app enables purchases and rewards within the Walmart network, providing valuable customer data for insights into behavior and preferences to inform future marketing and sales initiatives

Improved Security

Closed-loop wallets offer improved security compared to traditional payment systems. Since funds are pre-loaded in it, users do not need to provide sensitive financial information to complete a transaction.

This can help protect against fraud and other security risks, which can be especially important for merchants in industries that are particularly vulnerable to payment fraud.

For example, the Subway Card lets users preload funds onto a digital account for purchases within the network, eliminating the need for sensitive financial information at the point of sale and reducing the risk of fraud.

Prevent fraud with our foolproof platform for digital transactions

Reduced Transaction Costs

With their lower processing fees than traditional payment systems, closed-loop wallets can also help reduce transaction costs for merchants. This can be beneficial for smaller merchants that may not have the resources to absorb high payment processing costs.

For example, the Square Cash app permits sending and receiving payments within the Square network, where transactions are processed with lower fees compared to traditional payment systems. This proves advantageous for smaller merchants utilizing the Square payment system.

Streamlined Payment Process

Closed-loop wallets can help reduce checkout times and improve the overall customer experience, which can be especially important for busy merchants with high volumes of transactions.

For instance, the McDonald's app lets users pre-load funds onto a digital account for swift transactions within the McDonald's network, without needing to provide payment information at the point of sale.

Customizable Incentives

With closed-loop wallets, merchants can design customized rewards and incentives to match their customer base, leading to a better understanding of customer preferences and behavior. Targeted incentives help build customer loyalty and repeat business.

For example, Sephora's Beauty Insider program offers points for purchases, which can be redeemed for discounts, samples, and exclusive products. Sephora uses program data to create targeted incentives and foster greater customer loyalty.

Increased Brand Awareness

Closed-loop wallets enhance brand awareness and recognition for merchants, providing a distinctive payment experience tied to a specific network of merchants. This reinforces brand identity and strengthens the connection between customers and the merchant's brand.

For instance, the Dunkin' Donuts app enables purchases and rewards within its network, reinforcing brand identity and building a stronger customer connection. This increases brand awareness and recognition, leading to repeat business.

How Can Merchants Implement Closed Loop Wallets?

Choose the Right Closed-Loop Wallet Provider

The first step in implementing closed-loop wallets is to choose the right provider. Merchants should look for a provider that offers a range of features, including support for multiple payment methods, robust security features, and easy integration with existing payment systems.

Educate Customers

Once a closed-loop wallet is implemented, merchants should educate their customers on how to use it effectively and securely.

This may include providing information on how to load funds onto the wallet, how to make purchases, and how to protect against theft or fraud.

Invest in Security

Closed-loop wallets can pose security risks to both merchants and customers, particularly if they are not properly secured.

Merchants should invest in additional security measures, such as fraud detection and monitoring tools, to protect against theft and fraud.

Streamline Checkout Processes

To encourage the adoption of closed-loop wallets, merchants should streamline the checkout process to make it as easy and efficient as possible.

This may include implementing features like one-click checkout or mobile payment options to reduce friction and improve the overall customer experience.

Analyze and Optimize

Finally, merchants should regularly analyze and optimize their closed-loop wallet implementation to identify areas for improvement.

This may involve tracking metrics like adoption rates, average transaction value, and customer feedback to identify areas where the implementation can be optimized for better results.

Roadblocks in the implementation of closed loop wallets for merchants

While closed-loop wallets offer many benefits for both consumers and merchants, implementing them can also present a range of potential challenges.

These challenges may vary depending on the specific wallet provider, the merchant's industry and payment systems, and the overall level of customer adoption. They are:

Integration with Existing Payment Systems

Depending on the wallet type and the merchant's systems, enabling closed-loop payments may require substantial investment in new hardware/software or collaboration with a third-party provider.

Limited Customer Adoption

Closed-loop wallets are limited to a specific merchant network, which can make it harder to attract or retain customers who are not familiar with their advantages, compared to traditional payment methods that have wider acceptance.

Security and Fraud Risks

Closed-loop wallets pose security and fraud risks to merchants if not properly secured or if users are not educated on their secure use. Merchants need to invest in additional security measures and fraud detection tools to protect against theft or fraudulent transactions.

Regulatory and Compliance Requirements

Merchants must comply with various regulatory requirements when implementing closed-loop wallets, which may vary based on the wallet type and industry, to enable closed-loop payments legally.

Strategies to overcome the roadblocks in the implementation

Implementing closed-loop wallets can be a challenging task for merchants, but there are several strategies that can be employed to overcome potential roadblocks. These strategies include:

Integration Solutions

Merchants can simplify closed-loop wallet integration by working with payment processing providers or third-party integrators to create customized solutions, reducing technical barriers and streamlining the integration process.

Marketing and Education Initiatives

Merchants can increase customer adoption of closed-loop wallets through marketing and educational initiatives, like targeted ads, social media outreach, and educational materials. These efforts should emphasize the security, rewards, and convenience of closed-loop payments.

Security Measures

Merchants can improve security by implementing two-factor authentication, encryption, and tokenization to prevent fraud and protect customer data.

Compliance Solutions

Merchants can ensure compliance with regulations by working with compliance solutions providers or legal experts who specialize in closed-loop wallet systems.

Incentives and Rewards

Merchants can also offer incentives and rewards to customers who use closed-loop wallets for payments, such as loyalty points, discounts, or special offers. This can encourage customer adoption and promote repeat business.

What does the future of contactless payments hold?

Growth Projections for the future of contactless payments and closed loop wallets

According to various reports and studies, both contactless payments and closed-loop wallets are expected to see significant growth in the coming years.

Here are some of the growth projections for these payment methods:

Contactless Payments

The global contactless payment market size is expected to reach USD 164.15 billion by 2030, according to a report by Research and Markets.

The market is expected to experience growth as a result of the increased adoption of contactless payment technologies, such as Host-based Card Emulation (HCE) and Near Field Communication (NFC).

Closed Loop Wallets

A report by Allied Market Research projects that the global closed-loop wallet market size is expected to reach USD 1,552.50 million by 2026. The report cites the rise in smartphone penetration and the increasing adoption of contactless payment solutions as key drivers of growth for closed-loop wallets.

These growth projections demonstrate the increasing popularity and adoption of both contactless payments and closed loop wallets, as consumers and businesses seek more convenient and secure payment methods.

As technology continues to evolve and these payment methods become more integrated into everyday life, we will likely see even more growth and innovation in this space.

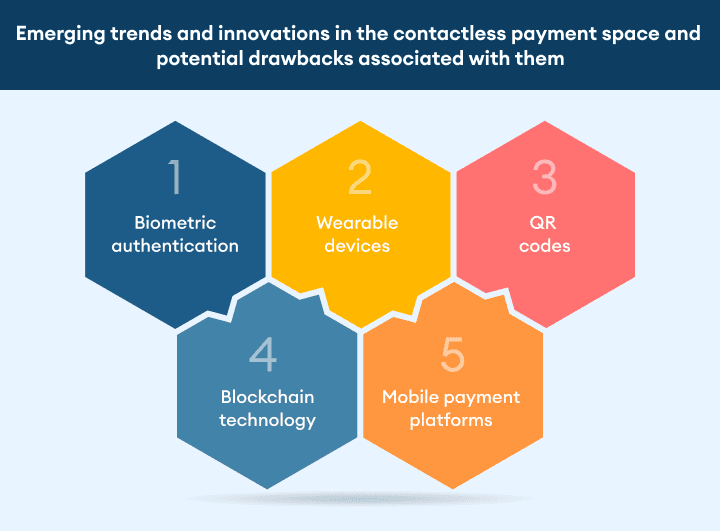

Emerging trends and innovations in the contactless payment space and potential drawbacks associated with them

The contactless payment space is constantly evolving, with new trends and innovations emerging all the time.

Here are some of the emerging trends and innovations in the contactless payment space, along with potential drawbacks associated with them:

Biometric authentication

Biometric authentication in digital payments, such as fingerprint or facial recognition, is increasingly used in contactless payments for added security and convenience, but privacy concerns arise from storing biometric data.

Wearable devices

Contactless payments are now integrated with wearable devices, like smartwatches or fitness trackers, for added convenience, but the risk of losing or stealing the device is a security concern.

QR codes

QR codes are gaining popularity in emerging markets for contactless payments, as they eliminate the need for NFC-enabled devices, and promote easy digital payments with QR codes.

Blockchain technology

Blockchain technology is being studied as a means of enhancing contactless payment security and efficiency, despite the potential scalability challenges associated with its use for payment processing.

Mobile payment platforms

Mobile payment platforms, like Apple Pay or Google Pay, are gaining popularity for contactless payments, offering enhanced security and convenience, but potential drawbacks include vendor lock-in and the need for a compatible device.

Best Practices for Merchants Using Closed Loop Wallets

As closed-loop wallets gain popularity as a payment option, it's important for merchants to adopt best practices to ensure a smooth and secure payment process. Closed-loop wallets are digital payment systems that enable customers to store money in an account associated with a particular merchant or service provider.

In this section, we will discuss the best practices that merchants should follow when using closed-loop wallets.

Simplify the Payment Process

Merchants should make sure that the payment process is as simple as possible. This means reducing the number of steps required to make a payment and ensuring that the checkout process is quick and easy.

Offer Rewards and Incentives

Merchants can incentivize customers to use closed-loop wallets by offering exclusive discounts or rewards for using the wallet to make a purchase. This can help drive adoption and loyalty among customers.

Ensure Security

Merchants must ensure that the closed-loop wallet is secure. This includes implementing robust security measures to protect customer data and prevent fraud. Merchants should also regularly monitor transactions to identify and prevent fraudulent activity.

Provide Customer Support

Merchants should provide customers with clear and concise instructions on how to use the closed-loop wallet and offer prompt support if any issues arise. Immense trust and loyalty among customers can be facilitated by this.

Continuously Improve

Merchants should continuously monitor and improve the closed-loop wallet experience. This can include gathering customer feedback and making improvements to the user interface, checkout process, or security features to ensure a smooth and seamless payment experience.

Best practices for merchants using futuristic contactless payments

As contactless payments become more prevalent, merchants need to ensure that they are using best practices to optimize their payment processes. Here are five key best practices for merchants using contactless payments:

Ensure Compatibility

Make sure your payment system is compatible with all the major contactless payment technologies, including NFC (near field communication), QR codes, and mobile wallet apps.

This will enable customers to use their preferred payment method, which can enhance their payment experience and increase the likelihood of them returning to your store.

Prioritize Security

Contactless payments are inherently secure, but you should still take steps to ensure that your payment system is as secure as possible.

This can include using tokenization, which replaces sensitive payment data with a unique identifier, and implementing two-factor authentication, which requires customers to provide additional verification before completing a payment.

Offer a Seamless Payment Experience

Contactless payments are all about convenience and speed, so it's important to offer a seamless payment experience.

This can include optimizing your payment terminals for quick and easy payments, reducing unnecessary steps in the payment process, and providing clear instructions for customers who may be new to contactless payments.

Educate Customers

Contactless payments are still relatively new, so it's important to educate customers about how they work and the benefits they offer.

This can include providing informational materials in your store, training your staff to answer common questions about contactless payments, and offering incentives for customers who try contactless payments for the first time.

Optimize for Speed

Contactless payments are designed to be fast and efficient, so it's important to optimize your payment system for speed.

This can include using payment terminals that are specifically designed for contactless payments, minimizing the number of steps in the payment process, and ensuring that your payment system can handle a large number of transactions without slowing down.

By prioritizing speed, you can ensure that your customers have a positive payment experience and are more likely to return to your store in the future.

Conclusion

Closed loop wallets are an essential aspect of contactless payment systems. So, it’s essential to understand the benefits and drawbacks these wallets can have for merchants. Merchants should prioritize security, compatibility, speed, and education when implementing contactless payments, as this can help ensure a seamless payment experience for their customers.

Moreover, by following the best practices for both closed loop wallets and other contactless payment methods, the merchants can make their businesses grow to their full potential and expand their business to gain profits.

DigiPay.Guru’s advanced closed-loop wallet solution allows merchants to deploy their self-branded wallets to help their customers to have a seamless payment experience. Moreover, our advanced contactless payment solutions like NFC, QR Code Payments, USSD, and Virtual Cards make your customer's transactions a whole lot easier & quicker.