Agency banking refers to the use of non-bank agents, such as retailers, telecommunications companies, or even individuals, to provide banking services on behalf of a financial institution.

These services can include account opening, deposits, withdrawals, and even loan disbursements. This approach allows banks to expand their reach and provide financial services to underserved populations who may not have access to traditional banking channels.

With the increasing use of mobile banking and digital platforms, many customers are looking for more convenient and personalized banking services. Agency banking allows banks to meet this demand by providing customers with access to banking services in locations and through channels that are more convenient for them.

According to the latest study by World Bank, it was found that globally the ownership of bank accounts has increased exponentially and has reached 76 % of the global population. This stat indicates that agency banking has boomed.

Additionally, agency banking can help banks to reduce costs and increase revenue streams by leveraging existing infrastructure and partnerships.

In this blog, we will explore the opportunities and trends in agency banking and to provide insights into how banks can take advantage of these opportunities to meet the changing needs of customers and stay ahead of the competition.

The current scenario of agency banking

The world of finance has been rapidly changing over the years, and one of the trends that have been gaining momentum is agency banking.

Agency banking is a banking model that involves the use of agents to provide financial services on behalf of a financial institution. It is a means of expanding financial services to areas that are underserved by traditional banking channels.

There are success stories of agency banking from various parts of the world. For instance, in Kenya, the M-Pesa mobile money platform has become a widely used and trusted means of financial transactions. In India, the Jan Dhan Yojana program has helped to bring banking services to millions of previously unbanked people.

Hence, agency banking has the potential to revolutionize the way banking services are delivered, especially in developing countries. As the financial landscape continues to evolve, it is important to keep a close eye on the current state of agency banking and the opportunities and challenges it presents.

Read more: The future of agency banking in Kenya

Opportunities in agency banking

Increased access to financial services for underserved populations

An agency banking solution allows banks to expand their reach and provide financial services to customers who may not have access to traditional banking channels, such as those living in rural areas or low-income households.

This can include services such as account opening, deposits, withdrawals, and even loan disbursements. By providing these services through non-bank agents, such as retailers or telecommunications companies, banks can reach customers who may not have access to traditional banking channels.

Cost savings for banks and customers

Agency banking can also help banks to reduce costs by leveraging existing infrastructure and partnerships. For example, a bank can use the existing networks of retailers or telecommunications companies to provide banking services, which can help to reduce the cost of setting up and maintaining physical branches.

Customers can also benefit from cost savings by being able to access banking services through non-bank agents, such as retailers, which can be more convenient and accessible than traditional banking channels.

Expansion of banking services in rural areas

Agency banking helps banks to expand their reach and provide services in areas where traditional banking channels may not be present. This can include rural areas where there may be limited access to banking services.

By working with non-bank agents, such as retailers or telecommunications companies, banks can provide services to these underserved areas, which can help to increase financial inclusion and promote economic development.

Expansion of banking services in rural areas

Agency banking helps banks to expand their reach and provide services in areas where traditional banking channels may not be present. This can include rural areas where there may be limited access to banking services.

By working with non-bank agents, such as retailers or telecommunications companies, banks can provide services to these underserved areas, which can help to increase financial inclusion and promote economic development.

Potential for increased revenue streams for banks

Agency banking provides banks with new revenue streams. For example, by working with non-bank agents, such as retailers, banks can leverage existing networks to provide additional services, such as remittances or insurance.

Additionally, banks can earn revenue from commissions on transactions made through agency banking channels.

Trends in agency banking

Increasing use of technology, such as mobile banking and digital platforms

With the growing use of technology, many customers are looking for more convenient and personalized banking services. Agency banking allows banks to meet this demand by providing customers with access to banking services through digital platforms, such as mobile banking apps or online portals.

This can include services such as account opening, deposits, withdrawals, and even loan disbursements. Additionally, with the increasing use of digital platforms, customers can easily access these services from any location, which can help to increase financial inclusion.

The growing partnerships between banks and non-traditional partners, such as retailers and telecommunications companies

Banks are increasingly partnering with non-traditional partners, such as retailers and telecommunications companies, to become agency banking services providers.

This can include partnerships with grocery stores, mobile phone companies, and other businesses that have existing networks and customer bases. These partnerships can help to expand the reach of banking services, increase revenue streams, and reduce costs.

Increasing focus on compliance and regulatory requirements

As agency banking becomes more widespread, there is an increasing focus on compliance and regulatory requirements. Banks must ensure that they are in compliance with all relevant regulations and that their non-bank agents are also adhering to these regulations.

This can include ensuring that customers' personal information is protected and that all transactions are recorded and reported correctly.

Rising demand for more personalized and convenient banking services

Customers are increasingly looking for more personalized and convenient banking services. Agency banking can help to meet this demand by providing customers with access to banking services through non-traditional channels, such as retailers or telecommunications companies.

Additionally, with the increasing use of technology, customers can easily access these services from any location, which can help to increase financial inclusion. So, it won't be wrong to say that if you know everything about agency banking, it will act as a next-gen solution for your business.

Read More: All You Need To Know About Agency Banking

Challenges faced in agency banking

Lack of trust and understanding among potential customers

One of the biggest challenges in agency banking is the lack of trust and understanding among potential customers. Many customers may be unfamiliar with agency banking and may not understand how it works or what services it offers. Banks must work to educate customers and build trust to increase the adoption of agency banking services.

Security concerns and potential for fraud

Another challenge is the potential for security breaches and fraud. As customers' personal information is being shared with non-bank agents, there is a higher risk of this information being compromised.

Banks must ensure that they have strong security measures in place to protect customers' personal information and that their non-bank agents are also adhering to these security measures.

Difficulty in scaling up and maintaining a large network of agents

The next challenge is the difficulty in scaling up and maintaining a large network of agents. Banks must ensure that they have the resources and infrastructure in place to support a large network of agents and that they can provide training and support to these agents as needed.

Limited access to capital and resources for banks and agents

There is limited access to capital and resources for banks and agents. Banks must ensure that they have the resources and infrastructure in place to support a large network of agents and that they can provide training and support to these agents as needed.

Additionally, banks and agents may have limited access to capital, which can limit their ability to grow and expand their agency banking services.

Conclusion

We discussed the opportunities and key trends in agency banking and highlighted the challenges facing the industry. It emphasized the importance of providing customers with convenient and personalized banking services and the benefits of expanding the reach of banking services through agency banking channels.

With the increasing use of technology, the growing partnership between banks and non-traditional partners, and the rising demand for more personalized and convenient banking services, the future of agency banking looks promising.

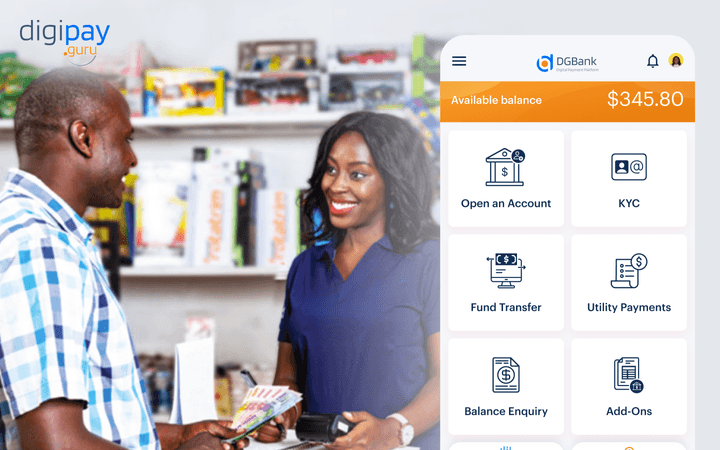

Banks can leverage the solutions offered by DigiPay.Guru's next-gen agency banking solution to take advantage of the opportunities and stay ahead of trends in agency banking. With our secure, reliable, and user-friendly branchless banking platform, banks can easily expand their reach, increase revenue streams and reduce costs.

By choosing DigiPay.Guru's agency banking solution, banks can provide their customers with convenient and personalized banking services, which can help to increase financial inclusion and promote economic development.