According to the Financial Times, 2018 was the year of the ‘silent revolution’ in the field of Open Banking Services. This pushed large banks to allow their clients to share their transaction data with other parties under new guidelines. Such measures will drive a wave of open data, putting $416 billion of revenue at stake.

Open Banking is not simply another business phrase, and if you don’t want to fall behind, you need to start learning about it today. Here is an introductory piece to help you hop on the journey of creating Open Banking solutions by explaining the new paradigm and its effect on the banking sector.

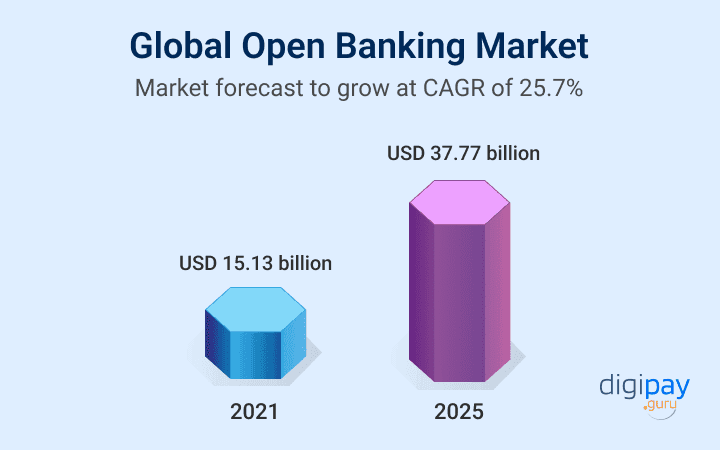

If you look at the digital payment trends the worldwide open banking industry will grow at a compound annual growth rate (CAGR) of 28.4%. The open banking sector rose from $11.79 billion in 2020 to $15.13 billion in 2021. The reversal in growth trajectory is mostly due to enterprises stabilizing their output following the epidemic in 2020, when demand rose rapidly. At a CAGR of 25.7%, it is predicted that the market will reach $37.77 billion by 2025.

Understanding the Basics of Open Banking

Proposed Interagency Guidance on Third-Party Relationships advocates the bank to ensure due diligence and overlook the transaction in the USA. These legislations modify the way banks handle their customers’ financial data. It is sometimes referred to as the ‘second payment services directive’ or the ‘revised payment services directive’ in Europe (PSD2). The Financial Conduct Authority (FCA) and European counterparts govern the Open Banking landscape.

The United States, unlike the United Kingdom, does not have a system of open banking regulation. Under Dodd-Frank Act section 1033, the Consumer Financial Protection Bureau (CFPB) can enact rules governing the sharing of consumer financial data.

It also includes budgeting applications and data of other banks, allowing new financial services to develop. Spending habits, recurring payments, and firms you use are among the information given. While the idea of users giving budgeting applications access to their bank accounts is not new, Open Banking assures that consumers’ data are in safe hands when they do so. Mobile money solution for your business is the right way to speed up the transaction.

Read More: Increase revenue and customer satisfaction with mobile money solutions

Functional Understanding of Open Banking

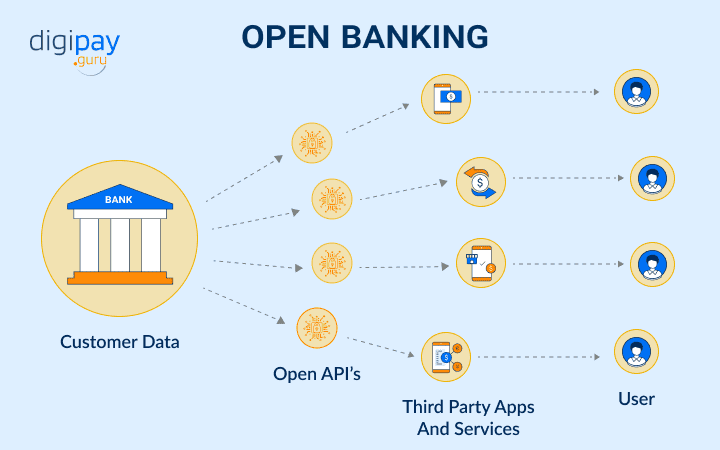

If you talk to people about open banking, you’ll rapidly run upon APIs, or Application Programming Interfaces, no matter where you go or what language you speak. APIs are the pipelines, connectors, and glue that allow banks and non-banks to communicate with one another. They are useful in every approach to providing Open Banking solution throughout the world.

Internally and externally, most banks have been on their API journeys for quite some time as a first step to offering digital wallet solutions. However, while APIs are usually used in open banking, establishing APIs does not automatically imply performing open banking, which is where the misunderstanding arises.

Some banks will claim open banking because they use APIs internally or connect to other partners, such as Visa or their preferred FinTech. Because each link will be developed based on customization and takes a particular relationship (and generally a specific project) to establish, we call it Partner Banking, not open banking, even though these connections utilize APIs.

Many banks have gone much further in recent years by launching Developer Portal or API Marketplace. It is a website where any third-party developer, regardless of affiliation, may view and utilize the APIs the Bank has revealed.

This strategy, which is a significant step ahead of Partner APIs, is built on Open APIs that anybody may access, allowing for the network effects of developing a platform. Mobile banking solutions are becoming more popular in the 21st century.

On the other hand, open APIs are not the same as open banking. A solution for Open banking would work only when all ecosystem’s members agree on a particular standard. The secret word that unites all definitions of open and Open Banking activities worldwide is the desire and necessity to set a standard for the financial ecosystem.

Regardless of the Bank, a common way to transmit data and a standard way to move money is the essence of open banking. You will find many digital wallet solutions in the market.

How does Open Banking work?

As previously said, open banking entails the release of data using APIs to access far more secure data than previous methods, such as screen scraping. Screen scraping entailed recording all of the information on your screen, much like taking a picture of it. You will find many digital wallet app development companies in the market.

Read More: Digital payment trends for upcomming years

However, in the case of Open Banking, the procedure in place assures superior levels of security to tackle digital payment frauds. This is because you need not reveal all of your personal information like login credentials or passwords, to anybody other than your Bank.

Consider the situation of a pricing comparison site as a simple example of how Open Banking works. In this circumstance, the Bank gives the website access to your banking information to offer you customized goods depending on your financial situation and willingness to spend. Open banking provides a branchless banking platform.

Examples of Open Banking

Sync, a London-based start-up, is a fantastic example of a firm that uses Open Banking as a part of mobile banking solution for business. This will let customers manage their financial accounts from several banks with the help of wallet app development.

WeBank’s connection with WeChat — a Chinese multi-purpose messaging, social networking, and mobile payment app is an example of how a bank uses Open Banking. Customers may use WeChat to book healthcare appointments, send money, and book cabs. Many banks are relying on agent banking solutions.

WeBank is China’s first digital Bank owned by a private company. We Bank may use WeChat’s extensive access to consumer data to analyze user preferences, activities, spending patterns, and financial transactions because Tencent launched both apps.

As a result, We Bank introduced Weilidai, its first online consumer microloan product, which WeChat pay customers may apply for straight from their WeChat applications. Many governments have been following the same by digitizing government-to-person payments.

What is the need of Open Banking?

The answer to what open banking is attempting to accomplish may also be broken down into three categories;

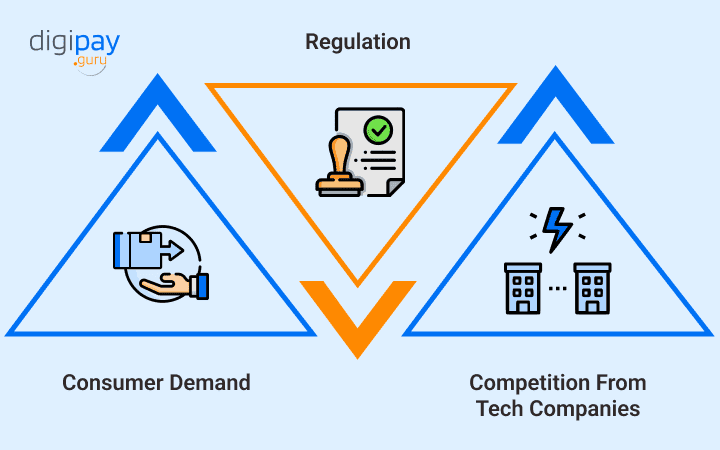

Consumer demand

The emergence of smartphones has fuelled the need for digitally native experiences. We all carry a smartphone in our pockets, and we want our service providers, including our banks, to interact with us in the same way. Customers demand reliable mobile banking software for a better user experience and this is where digital wallet solutions become useful.

Regulation

PSD2 in Europe or other open banking rules throughout the world was the final straw before the dramatic shift occurred. Market-led attempts to embrace standards, even if not government-led, can operate as de facto regulation, pressuring institutions to adapt.

Competition from tech companies

Large and small IT businesses are increasingly conquering territory previously designated for banks by offering banking-like services. New rivals cause the second type of disruption. Your business must find wallet app development companies to build digital wallets through open banking. Otherwise, developers can help you in e-wallet application development.

What is the goal of Open Banking?

The answer to what open banking is striving to attain may also be broken down into three categories;

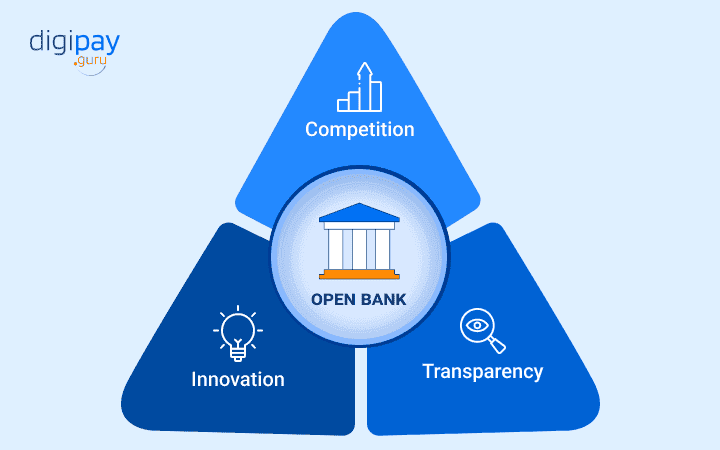

Innovation

The idea here is to develop completely new financial products that didn’t exist before (i.e., blue ocean products). Allowing technology businesses to enter the market and link data together to develop inventive solutions is part of the open banking journey.

Transparency

The sole purpose is to ensure that all hidden fees and prices that drive the financial sector will be transparent in the public domain. With its help, one can compare, contrast, and even shift from one institution to another. Effective digital payments are the key to financial transactions.

Competition

The goal is to allow new entrants into the market while reducing the hassles around financial services. In the end, increasing competition leads to market efficiency, which lowers financial service costs. Many companies are adopting digital payment fraud to be competitive in the market.

These three areas of aims, when combined, aim to create a far more dynamic, flexible, and stable financial system.

Advantages of Open Banking for clients and businesses

Security

Data security in digital wallet solutions has become more important in recent years, and open banking is no exception. Security is a must to prevent digital payment fraud. Despite some reservations, the process is as safe as online banking.

To begin with, banks have technological platforms in place, such as strong customer authentication, which needs two-step authorization for extra protection. APIs add another layer of protection against fraud by encrypting data and securely sending information.

An open banking platform will connect to banks using approved PSD2-compliant APIs. This guards against data breaches and guarantees that all methods are safe and reliable. Furthermore, clients must agree that security is crucial for large payments. That’s why you need a bulk payment solution.

Streamlines payment

Fast payments are inevitable in today’s fast-paced world. Open banking ePayment is the most increasingly popular payment method working smoothly in the EMEA nations. It has been possible because of open banking. Payments may be transmitted and received relatively instantaneously using OBeP.

This is not only more convenient, but it also lowers the danger of non-payment for everyone who offers an online service. Users will have to wait no more, and payment will be verified and guaranteed right away.

New business opportunities

More entrepreneurs and start-ups may now enter the financial industry without being constrained by established financial infrastructure thanks to the rise of open banking. Removing past constraints allows for healthy competition to flourish within the industry.

Regulations governing open banking have paved the way for an ever-increasing number of new services and products that benefit customers. Contactless payments for digital payment can drive sales of your business.

Tailored approach

The customization enabled by open banking opens up a world of possibilities for financial services. Digital wallet app development may gather consensually obtained information on clients through open banking, allowing them to build hyper-personalized experiences.

For users of banking services and products, a personalized approach is preferable. Customers have expressed a need for tailored services and product offerings as per their requirements. Personalization helps in choosing the best amongst the various modes of cashless transactions.

Full proof of online banking

Visiting brick-and-mortar banks for any of your financial requirements was not appealing even before the times of the pandemic. You can implement solutions for Open Banking that allows customers to choose a digital experience instead.

Customers are beginning to demand the same from their digital finance solutions providers as digital platforms rise in popularity across all industries. Any players that can grow in this manner will have a better chance of establishing themselves in the market. You will find a complete guide on bulk payments that can help in full proof online banking.

One-stop solution

The ability to access all of your financial services in one place is one of the most significant advantages of open banking. Thanks to mobile applications and digital services, customers may now connect to all of their bank accounts and payment systems through a single app. This will save time and ensure that clients have all the crucial information about what is going on with their accounts.

Automation and speed

Financial data and transactions are shared across all of your financial platforms, allowing for speedier operations that benefit the customer in the end. The crucial information supplied gives a complete and accurate financial history.

It can assist streamline and speed up the application process when securely shared with loan, credit, and mortgage professionals. E-wallet payment systems should provide speed and security.

Accessibility

While not visiting a real bank may be inconvenient for some, it may provide a more significant difficulty for others. Those who live in distant locations, people with impairments, and people who go outside the nation have all encountered the problem of financial services being inaccessible.

This might lead us to one question: do you have access to technology? If your answer is affirmative, you can access your financial platforms anywhere, giving you greater flexibility and control. For better accessibility, businesses can rely on wallet solutions.

Modern banking solutions

Banks and fintech businesses do not have to compete in open banking. On the other hand, open banking allows all companies to link their infrastructure to coexist and collaborate to build new, creative solutions and services for clients.

This gives the financial industry more freedom to expand and develop, ensuring that more company and customer demands are satisfied in the future. Find a complete guide on bulk payments. Digital wallet development companies will make a job easier for you.

Focus on customers

The client is at the heart of the open banking model. Open banking offers a simplified approach, simplicity, accessibility, quickness, and customized experience. Collaboration and competition within the industry will continue to create customer-focused offerings as long as open banking flourishes. This will make the whole process easier, reliable and efficient for the end-user.

Conclusion

Personalization and fast technological innovations were costly before the advent of Open Banking. Even if consumers had an innate need for personalized products and services, banks lacked the resources to provide that demand.

Open Banking solutions provide a middle ground that democratizes personalized services while maintaining cost-effectiveness. Banks will not have to make the tough call in choosing personalized services and cost-cutting.

Herein lies the significance of Open Banking that can completely transform the function of financial institutions in society. It can potentially alter how banks, clients, and partners will interact at the financial level as the industry undergoes a significant transformation.